KSE-100 slips below 119,000 but still closes at another record high

- Positive news flow from energy sector, IMF fuel buying rally

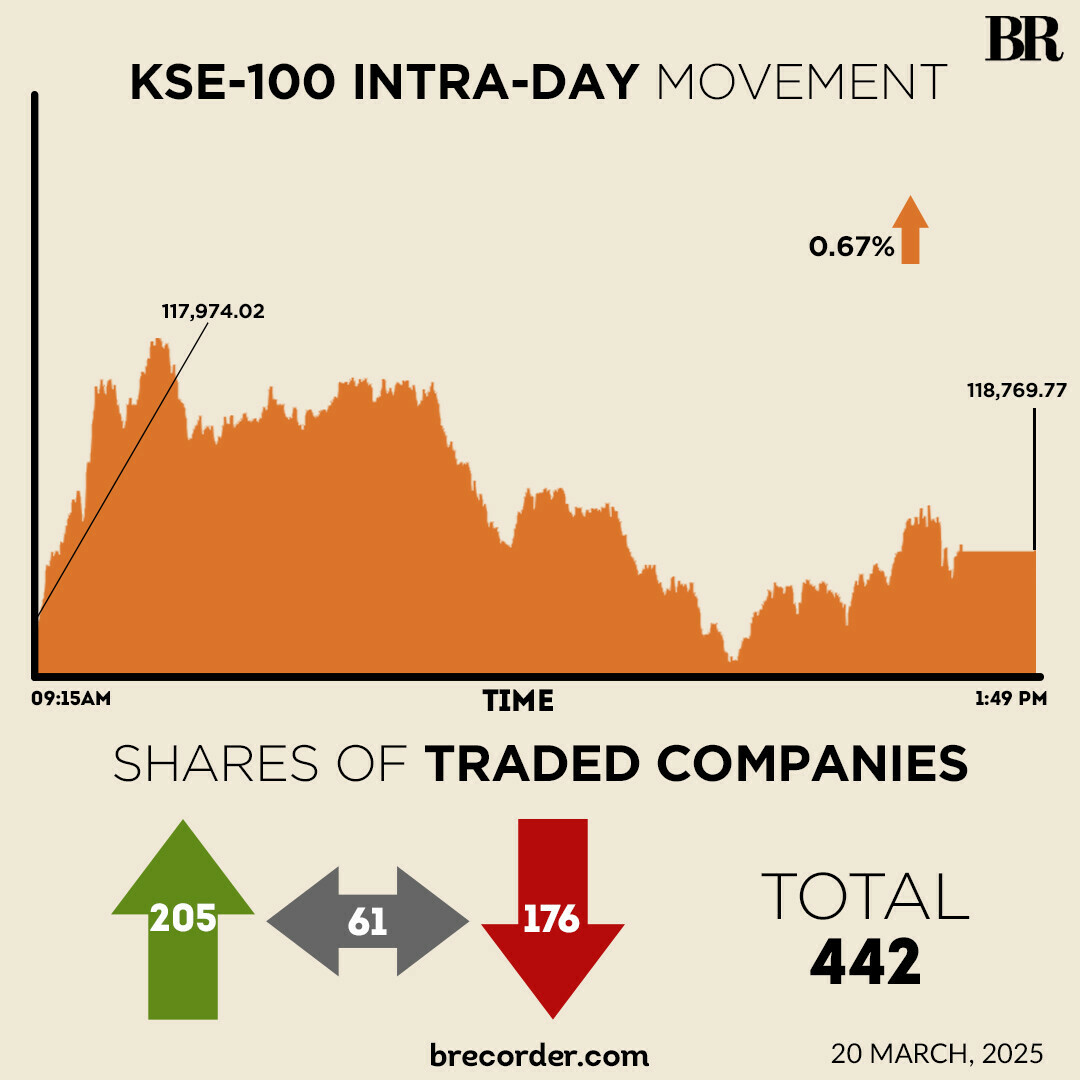

Pakistan Stock Exchange (PSX) continued its record-breaking run as the benchmark KSE-100 Index crossed the 119,000 level, for the first time, before closing at a new high of 118,769.77 on Thursday.

Bullish momentum prevailed through most of the trading session, pushing the KSE-100 Index to a record intra-day high of 119,421.81.

However, profit-taking in the final hours of the session trimmed market gains.

The benchmark index settled at 118,769.77 level, a new high, amid a gain of 795.75 points or 0.67%.

Buying was observed in key sectors including oil and gas exploration companies, OMCs, power generation and refineries. Index-heavy stocks traded in the green, including HUBCO, NRL, SNGPL, SSGC, MARI, OGDC, and PPL.

The positive momentum was fuelled by positive news flow regarding the resolution of energy sector circular debt and market anticipation of a Staff-Level Agreement (SLA) with the International Monetary Fund (IMF).

The buying rally comes amid “improvement in cash flow of energy chain and a potential deal with the IMF,” Samiullah Tariq, Head of Research at Pak Kuwait Investment Company (Private) Limited, told Business Recorder.

Mohammed Sohail, CEO Topline Securities, echoed similar sentiments.

“Index at another high of 119k led by local institutional buying,” Sohail said in a note.

“There is optimism that the IMF staff-level deal will be done soon. Moreover, government efforts to resolve old circular debt will help emerging sector companies’ cash flows,” he added.

On Wednesday, the benchmark KSE-100 Index gained nearly 1,000 points to settle at a new all-time high of 117,974.02.

Internationally, Asia shares were hobbled by weakness in Chinese markets on Thursday and struggled to build on Wall Street’s rally, even as investor sentiment was lifted by the prospect that the Federal Reserve could still deliver two rate cuts this year.

The Fed on Wednesday left rates unchanged in a widely expected decision, but maintained its projection for two quarter-percentage-point rate cuts by the year-end.

Policymakers did revise their inflation forecast for the year and marked down their outlook for economic growth, citing risks from US President Donald Trump’s tariff policies.

Still, investors took comfort from the Fed’s “dot plot” of policy rate expectations and Chair Jerome Powell’s comments that tariff-driven inflation will be “transitory” and largely confined to this year, in turn sending stocks higher while US Treasury yields and the dollar fell.

Australian shares jumped 1%, while US futures also extended their rally after the cash session ended on a high.

Nasdaq futures ticked up 0.4% and S&P 500 futures advanced 0.3%. EUROSTOXX 50 futures similarly added 0.1%.

Trading was thinned with Japan markets closed for a holiday, though Nikkei futures edged up 0.2%.

Volume on the all-share index increased to 667.88 million from 544.20 million recorded in the previous close.

Whereas, the value of shares improved to Rs38.53 billion from Rs32.31 billion in the previous session.

Cnergyico PK was the volume leader with 163.98 million shares, followed by B.O.PunjabXD with 45.89 million shares, and Pak Refinery with 45.15 million shares.

Shares of 442 companies were traded on Thursday, of which 205 registered an increase, 176 recorded a fall, while 61 remained unchanged.

Comments