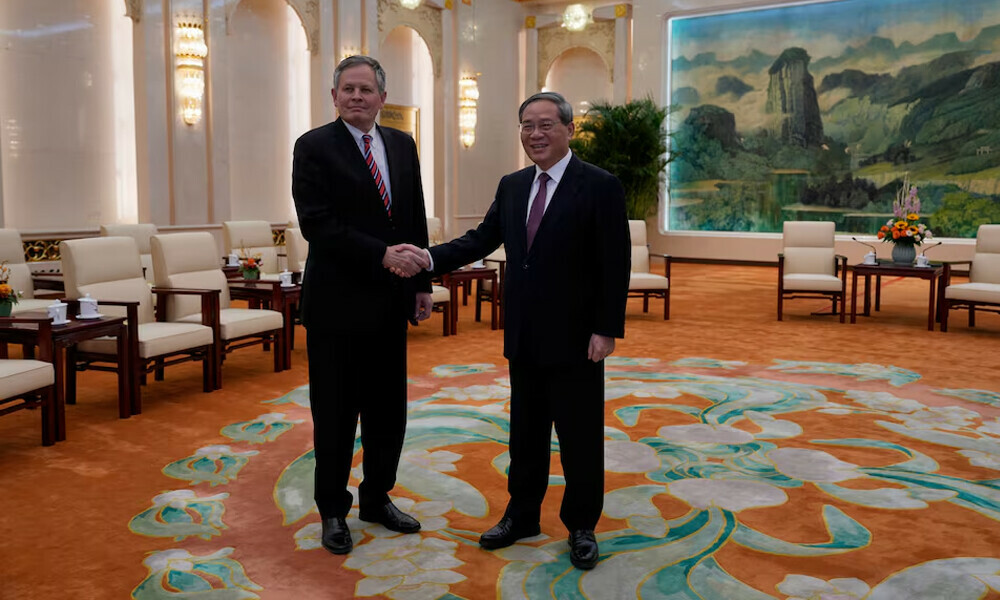

BEIJING: US Republican Senator Steve Daines met Chinese Premier Li Qiang in Beijing with a group of executives from US companies on Sunday, following an annual business summit in the capital attended by CEOs from big foreign firms.

Daines was accompanied by seven senior executives including Qualcomm CEO Cristiano Amon, Pfizer CEO Albert Bourla, Cargill CEO Brian Sikes and Boeing Global Senior Vice President Brendan Nelson in the talks at Beijing’s Great Hall of the People, a foreign media pool report said.

Daines’ trip marks the first time an American politician has visited China since US President Donald Trump took office in January. Beijing is seeking high-level dialogue with the Trump administration, hoping to reach a deal to avert further pressure on tariffs from Washington.

Daines, a staunch supporter of Trump and member of the Senate Foreign Relations Committee, was heavily involved in negotiations over US-China trade during Trump’s first term as president, and has made multiple trips to China as a senator.

He lived in Guangzhou and Hong Kong in the 1990s while working as an executive for Procter & Gamble, which he referenced in his opening speech.

“Collectively, these seven companies have over 275 years of experience of doing business in China,” Daines said as he introduced the CEOs, according to a pool transcript.

TARIFF PRESSURE

Beijing has been trying to attract foreign investment to offset US tariff pressure and its slowing domestic economy.

The US executives were granted an audience with Li Qiang, who will not meet separately with other foreign CEOs at the China Development Forum for the second year in a row. The annual closed-door meeting with the premier was traditionally viewed as a summit highlight by foreign firms’ CEOs, who have long complained of an unequal playing field, regulatory hurdles and restricted market access in China. Relations between China and the US have come under new strain after Trump slapped additional tariffs on Chinese goods, accusing Beijing of not doing enough to stem the flow of fentanyl into the United States.

In early April, Trump is expected to unleash a round of tariffs on all countries that tax US imports, potentially including China. A US review of whether China has fulfilled promises made during the “phase one” trade deal from Trump’s first administration is set to conclude on April 1.

In his opening remarks, Daines pitched Sunday’s meeting as a chance for them to air their views on the business environment in China directly to Li. “There are no winners in a trade war,” Li told Daines in their meeting, stressing the importance of economic and trade ties in overall US-China relations. “China … will actively promote solutions to the legitimate demands of enterprises, treat domestic and foreign enterprises equally,” Li said, according to a Xinhua report. Other Chinese officials at the meeting included Commerce Minister Wang Wentao, Executive Vice Foreign Minister Ma Zhaoxu, and the director of China’s state planner, Zheng Shanjie.

Daines met Chinese Vice Premier He Lifeng in Beijing on Saturday, and discussed with him the need for China to stop the flow of fentanyl precursors, according to a post by Daines on the X social media platform.

Comments