Most stock markets in the Gulf ended higher on Thursday, reversing early losses, as investors assess the impact of U.S. President Donald Trump’s latest tariff announcement.

Trump on Wednesday unveiled a 25% tariff on imported cars and light trucks starting next week, widening the ongoing trade war that’s been fuelling market volatility.

Saudi Arabia’s benchmark index gained 0.5%, with Saudi Arabian Mining Company rising 2.2% and Riyad Bank closing 1.4% higher.

Elsewhere, oil giant Saudi Aramco increased 0.4%.

Aramco is in talks to invest in two planned refineries in India as the world’s top oil exporter looks for a stable outlet for its crude in the world’s fastest-growing emerging market, Reuters reported on Thursday, citing several Indian sources with direct knowledge of the matter.

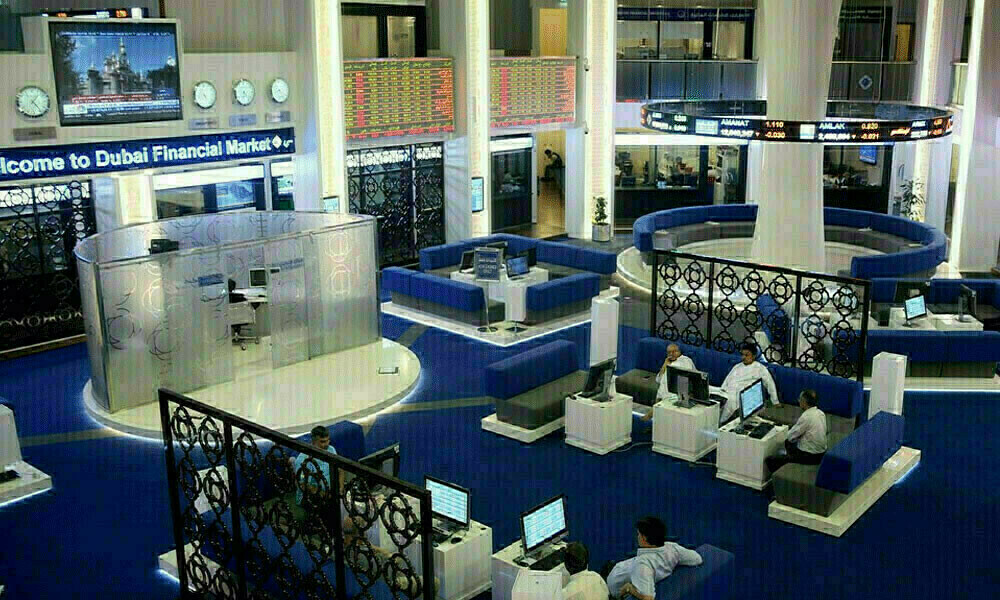

Dubai’s main share index nudged 0.1% higher, helped by a 4.1% jump in Parkin Company, which oversees public parking operations in the emirates.

In Abu Dhabi, the index added 0.2%.

Oil prices - a catalyst for the Gulf’s financial markets - were steady as markets assessed the new U.S. tariffs, while concerns about global supply kept prices near one-month highs.

Most Gulf markets fall on US tariff uncertainty

The Qatari index concluded 0.5% higher, with the Gulf’s biggest lender Qatar National Bank gaining 0.9% and petrochemical maker Industries Qatar edging up 1.7%.

On the other hand, sharia-compliant lender Masraf Al Rayan slid 3.4%, as the bank traded ex-dividend.

Outside the Gulf, Egypt’s blue-chip index rose 0.9%, as most of its constituents were in positive territory including tobacco monopoly Eastern Company, which was up 2.2%.

Egypt’s cabinet approved a 4.6 trillion Egyptian pound ($91 billion) draft state budget for the financial year that will begin in July, a government statement said on Wednesday, as it continues to tighten its finances under an IMF programme.

--------------------------------------- SAUDI ARABIA rose 0.5% to 12,025 Abu Dhabi up 0.2% to 9,390 Dubai added 0.1% to 5,120 QATAR gained 0.5% to 10,233 EGYPT rose 0.9% to 32,026 BAHRAIN finished flat at 1,951 OMAN fell 0.8% to 4,367 KUWAIT added 0.1% to 8,675 ---------------------------------------

Comments