Thatta Cement Company Limited

Thatta Cement Company Limited (PSX: THCCL) was incorporated in Pakistan as a public limited company in 1980. The company is engaged in the manufacturing and marketing of cement besides holding the ownership of Thatta Power (Private) Limited.

Pattern of Shareholding

As of June 30, 2024, THCCL has a total of 99.718 million shares outstanding which are held by 2024 shareholders. Associated companies, undertakings, and related parties have the majority stake of 54.33 percent in the company followed by the local general public holding 15.72 percent shares of THCCL. The foreign general public holds 4.66 percent shares of the company while banks, DFIs, and NBFIs account for 3.39 percent of shares. Around 1.64 percent of THCCL’s shares are held by Modarabas & Mutual Funds and 1.26 percent by Directors, CEO, and their spouse and minor children. The remaining shares are held by other categories of shareholders.

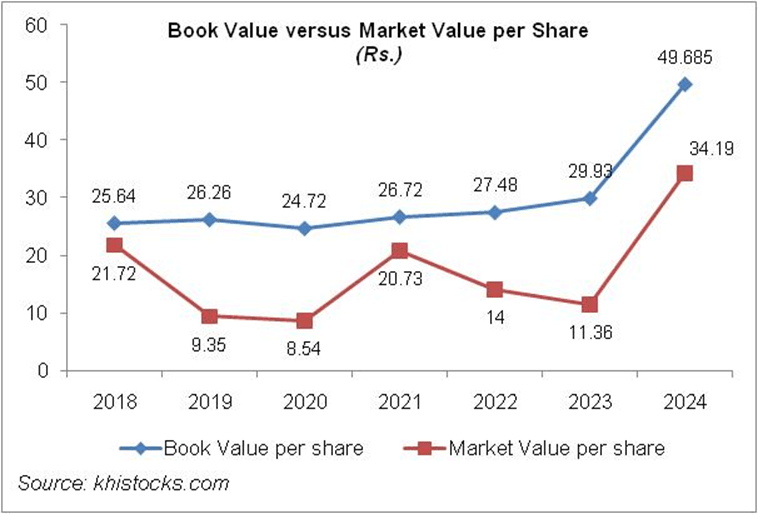

Financial Performance (2019-24)

Except for a year-on-year plunge in 2020, THCCL’s topline followed an upward trajectory over the period under consideration. Conversely, its bottom line slid in 2019 and 2020, registering a net loss in the latter year. In 2021, THCCL recorded net profit which plummeted the very next year. In 2023 and 2024, the company’s bottom line considerably expanded. Its margins followed a downright declining trend until 2020 followed by a rebound in 2021. In 2022, the margins drastically fell followed by an uptick in 2023. In 2024, THCCL’s margins posted staggering growth and attained their optimum level (see the graph of profitability ratios). The detailed performance review of the period under consideration is given below.

In 2019, THCCL’s topline posted a 22.02 percent year-on-year rise to clock in at Rs.3,468.41 million. During the year, the company’s cement off-take dropped by 6.46 percent to clock in at 368,057 MT due to intense price competition on account of excess availability in the market. Consequently, the company started exporting clinker which resulted in its off-take growing up by 1155.42 percent in 2019 to clock in at 188,890 MT. Despite a higher proportion of export sales vis-à-vis last year, the company couldn’t gain higher margins due to a considerable hike in the coal prices, packing material and other input and conversion costs which coupled with Pak Rupee depreciation resulted in 11.12 percent thinner gross profit in 2019 with GP margin clocking in at 19.37 percent versus GP margin of 26.6 percent recorded in 2018. Distribution expenses multiplied by 213.51 percent in 2019 on account of export logistics and related charges incurred during the year. Administrative expenses dropped by 16.57 percent in 2019 due to lower payroll expenses as THCCL squeezed its workforce from 530 employees in 2018 to 511 employees in 2019. Other expenses also slumped by 33.82 percent in 2019 due to lower profit-related provisioning while other income dropped by 39.28 percent in 2019 as THCCL recognized no mark-up income from advances to subsidiaries during the year. Operating profit declined by 38.46 percent in 2019 with OP margin clocking in at 9.97 percent versus OP margin of 19.77 percent recorded in 2018. Despite a higher discount rate, THCCL was able to cut down its finance cost by 21.79 percent in 2019 due to a reduction in outstanding long-term loans. THCCL net profit contracted by 40.17 percent in 2019 to clock in at Rs.213.52 million with EPS of Rs.2.14 versus EPS of Rs.3.58 registered in the previous year. NP margin also dropped from 12.55 percent in 2018 to 6.16 percent in 2019.

This was followed by a 49.39 percent year-on-year decline in THCCL’s topline which clocked in at Rs.1755.23 million in 2020. During the year, the company’s overall sales volume dropped by 49.84 percent to clock in at 279,488 MT. Lower sales volume was due to a 70.36 percent decline in export off-take and a 41.81 percent decline in local off-take – the reason being the availability of surplus capacities which led to price wars and also because of deceleration of construction activity due to COVID-19 towards the end of FY20. Due to lower capacity utilization, fixed cost was charged as period cost, resulting in 92.25 percent lower gross profit recorded in 2020. GP margin drastically fell down to 2.97 percent in 2020. Distribution expenses shrank by 59.25 percent in 2020 due to lower export sales. Administrative expenses also sank by 17.46 percent in 2020 due to further shrinkage in the workforce which stood at 497 employees in 2020. Other expenses slipped by 42.24 percent in 2020 as the company didn’t book any provisioning for WWF and WPPF during the year. Other income mounted by 45.56 percent in 2020 due to increased income from waste heat recovery and higher management fees received from Thatta Power (Private) Limited for business support services provided during the year. Despite keeping a meticulous check on its expenses, THCCL recorded an operating loss of Rs.96.78 million in 2020. Finance costs dropped by 12.78 percent in 2020 due to no outstanding long-term borrowings. THCCL posted a net loss of Rs.158.02 million in 2020 with a loss per share of Rs.1.58.

In 2021, THCCL’s topline registered a 38.29 percent rise to clock in at Rs.2427.31 million. This was on account of a 32.6 percent increase in sales volume which clocked in at 370,610 MT in 2021. Local sales volume increased by 52.21 percent while export sales volume shrank by 65.27 percent in 2021. Cost optimization strategies put in place during the year coupled with better pricing resulted in a 638.31 percent higher gross profit recorded in 2021 with a GP margin of 15.85 percent. Distribution expenses slid by 13.75 percent in 2021 due to lower export sales volume. Administrative expenses multiplied by 15.58 percent due to higher payroll expenses despite the fact that the number of employees remained intact at 497. Other expenses grew by 21.24 percent due to higher profit-related provisioning. However, it was offset by 80.53 percent higher other income recorded in 2021 due to higher exchange gain, elevated management fee received from the subsidiary company, and increased income from waste heat recovery. THCCL recorded an operating profit of Rs.267.19 million in 2021 with an OP margin of 11.01 percent. Finance costs slid by 61.34 percent in 2021 due to monetary easing. THCCL recorded a net profit of Rs.201.79 million in 2021 with EPS of Rs.2.02 and NP margin of 8.31 percent.

THCCL’s topline recorded a staggering 75.66 percent growth in 2022 to clock in at Rs.4,263.89 million. This was on account of a 37.47 percent year-on-year increase in the overall dispatches of the company which stood at 509,483 MT in 2022. During the new the company tapped new market segments which buttressed its sales volume. However, significantly lower export sales took its toll on the margins of the company. Besides, elevated coal prices, Pak Rupee depreciation as well as purchase of electricity from HESCO due to the non-availability of gas to Thatta Power (Private) Limited, drove up the cost of sales of THCCL by 93 percent in 2022. This resulted in a 16.65 percent decline in THCCL’s gross profit in 2022 with GP margin falling down to 7.52 percent. Distribution expenses narrowed down by 24.28 percent in 2022 due to lower export logistics and related charges. Administrative expenses surged by 19.3 percent in 2022 due to workforce expansion which stood at 501 employees, resulting in higher payroll expenses. THCCL recorded 83.87 percent higher other expenses in 2022 due to hefty exchange loss owing to Pak Rupee depreciation. THCCL’s operating profit tumbled by 29.58 percent in 2022 with OP margin shrinking to 4.41 percent. Finance costs surged by 95.52 percent in 2022 due to monetary tightening. The company recorded a 40.88 percent decline in its bottom line which stood at Rs.119.294 million in 2022 with EPS of Rs.1.2 and an NP margin of 2.8 percent.

In 2023, THCCL’s topline expanded by 26.88 percent to clock in at Rs. 5,410.13 million. During the year, the company’s local cement dispatches dropped by 13.03 percent to clock in at 438,739 MT while it made no clinker sales which also implies no export sales. Overall industry’s export volumes also dropped during the year due to high prices of coal, Pak Rupee depreciation, and higher shipping charges. Despite thinner volume, the company was able to register topline growth and increased margins due to a substantial increase in cement retention prices. Gross profit increased by 31.16 percent in 2023 with GP margin ticking up to 7.77 percent. Distribution expenses escalated by 50.97 percent in 2023 due to higher freight charges. Administrative expenses also soared by 24 percent due to higher payroll expenses despite the reduction in the number of employees which stood at 493 in 2023. Lower exchange loss culminated in a 30.43 percent decline in other expenses in 2023. Other income made a tremendous 197 percent growth due to an increase in profit from bank deposits and TDRs as well as higher management fees and income from waste heat recovery. Operating profit multiplied by 120.78 percent in 2023 with OP margin climbing up to 7.68 percent. Finance costs surged by 52.38 percent in 2023 on account of an unprecedented level of discount rate. Net profit increased by 108.79 percent in 2023 to clock in at Rs.249.077 million with EPS of Rs.2.72 and NP margin of 4.6 percent.

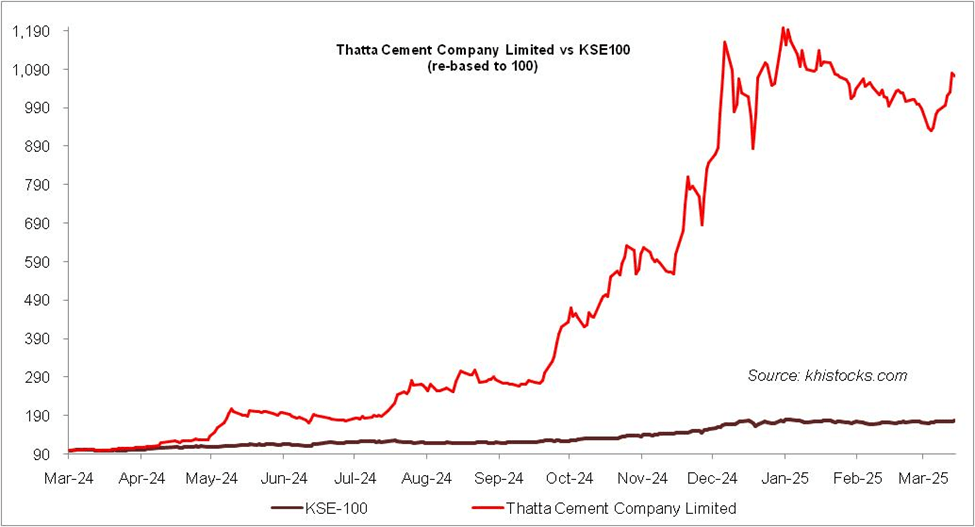

THCCL’s topline posted 39 percent year-on-year growth to clock in at Rs.7,521.58 million in 2024. This was on account of 22.57 percent higher dispatches which clocked in at 538,335 MT in 2024. This included a 21.68 percent increase in cement dispatches which was recorded at 533,880 MT and an 887.80 percent rise in clinker dispatches which stood at 4,455 MT in 2024. High retention prices and cost optimization measures such as local sourcing of coal and implementation of a 3.5 MW solar energy project culminated in a 414.55 percent rise in gross profit and GP margin of 28.77 percent. Distribution expenses dropped by 38 percent in 2024 due to lower salaries of the sales force, no export-related expenses, and lower freight charges incurred during the period. Administrative expenses dipped by 0.65 percent in 2024 as the company further squeezed its workforce which stood at 409 employees. Other expenses magnified by 491.47 percent in 2024 on account of higher profit-related provisioning done during the year. However, it was offset by 187.68 percent higher other income recorded in 2024 due to higher profit from deposit accounts and TDRs as well as increased income from waste heat recovery. THCCL’s operating profit rebounded by 508.18 percent in 2024 with an OP margin of 33.59 percent. Finance costs inched up by 4.78 percent due to a higher discount rate. THCCL recorded lower short-term borrowings and no long-term borrowings outstanding at the end of 2024. This was because the company improved its working capital cycle which improved its liquidity. Net profit improved by 502.64 percent to clock in at Rs.1501.037 million with EPS of Rs.16.40 and NP margin of 19.96 percent.

Recent Performance (1HFY25)

During the first half of FY25, THCCL’s topline posted year-on-year growth of 23.23 percent to clock in at Rs.3,849.59 million. This came on the back of a 12.28 percent improvement in the company sales volume which in turn was the result of better local sales and higher retention prices. The cost of sales grew by only 7.53 percent in 1HFY25 due to cost optimization strategies put in place by the company such as the installation of a 5 MW solar power plant.. This resulted in 81.72 percent stronger gross profit recorded in 1HFY25 versus the same period last year. GP margin jumped up from 21.16 percent in 1HFY24 to 31.21 percent in 1HFY25. Distribution expenses grew by 11.61 percent in 1HFY25 due to higher sales volume which pushed up the freight charges. Conversely, administrative expenses narrowed down by 12.74 percent in 1HFY25. Higher profit-related provisioning appears to be the reason for the 170.90 percent spike in other expenses in 1HFY25. However, it was completely offset by 333.25 percent bigger other income recorded by the company in 1HFY25. Higher other income was due to a royalty reversal of Rs. 150.84 million as The Department of Minerals and Mines Department, Government of Sindh made a downward revision in the prices of Limestone and shale clay. This resulted in the reversal of excess provision in respect of royalty. THCCL recorded 163.78 percent higher operating profit in 1HFY25 with OP margin clocking in at 45.45 percent versus OP margin of 21.23 percent recorded in 1HFY24. Finance costs dipped by 4 percent during the period due to monetary easing. Net profit strengthened by 214.88 percent to clock in at Rs.1,127.53 million in 1HFY25 with EPS of Rs.13.31 versus EPS of Rs.3.64 recorded in 1HFY24. NP margin also significantly improved from 11.46 percent in 1HFY24 to 29.29 percent in 1HFY25.

Future Outlook

With the improvement in the macroeconomic backdrop, cement demand will gradually recover. However, overall dispatches for FY25 may remain low due to lower PSDP disbursement. Moreover, the rising capacities of cement facilities over the years coupled with frail demand has resulted in a significant demand-supply gap. Amid such a situation, will the cement sector be able to enjoy high retention prices for long is yet to be seen.

During 1HFY25, THCCL acquired 12.5 million shares of Thatta Power (Private) Limited (TPPL), resulting in a revised ownership stake of 88.52 percent. This will give THCCL better control over TPPL’s operations. THCCL also invested in Minsk Work Tractor & Assembling (Private) Limited. These diversified investments will open new avenues of alternate income for the company.

Comments