Not quite the contortions of Trump’s tariff theatrics, but Pakistan’s top brass wasn’t far behind with its own brand of mathematical acrobatics. The occasion? An “Eid gift” in the form of an electricity relief package—wrapped in optics, sprinkled with selective arithmetic, and served with a side of populist flair.

First things first: any respite is better than none. Consumers have been on the receiving end of relentless tariff shocks for the better part of the last two and a half years. A breather - however calibrated- was overdue. It was also seen coming (see: Power tariffs: Massive respite on the cards, published Feb 12, 2025).

And now, to the meaty part. Much has been made of the precise-sounding Rs 7.41/unit relief for domestic consumers - and a touch more generous for industry. The only hitch? That number seems plucked from a magician’s hat. Unless the government is sitting on some classified tariff wizardry, the math doesn’t quite add up.

The only way to arrive at that “average” Rs7.41 per unit drop is by carefully selecting your starting line—read: not March 2025, but some point in the past where tariffs peaked higher. In other words, the goalpost has not just been moved—it’s been relocated to another stadium altogether.

Some context helps. The power regulator heard the government’s petition to reduce electricity tariffs by Rs1.71/unit and is likely to sail through as petitioned. The proposed relief is due to last for three months ending June 2025 as the government intends to finance it via additional Tariff Differential Subsidy (TDS) – likely to be sourced from additional revenue generated through the recent imposition of levy on gas usage for captive power generation and/or via additional revenue generated through the additional Rs10/ltr Petroleum Levy on POL products.

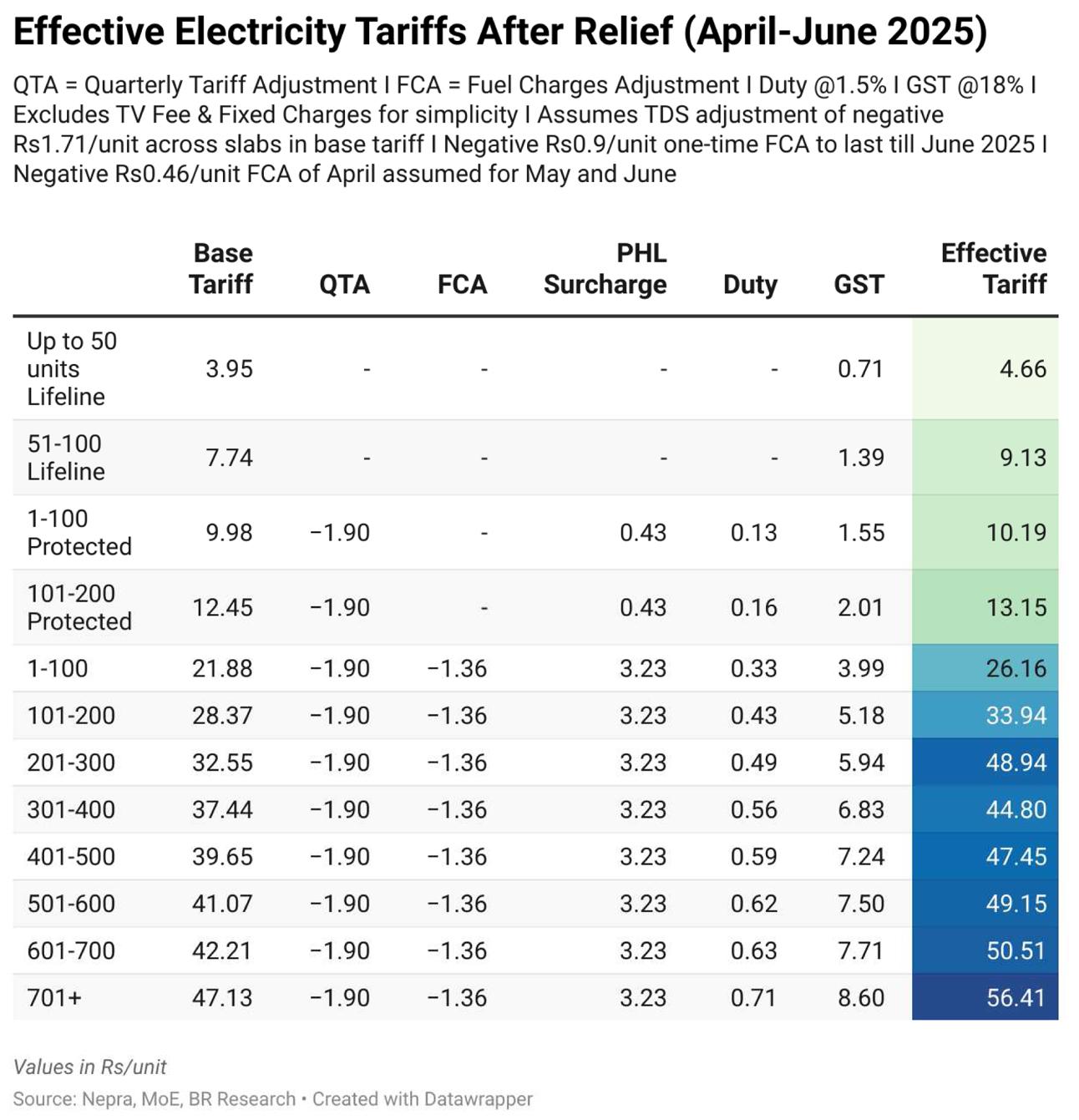

The next relief comes through periodic adjustment, as the much-delayed Quarterly Tariff Adjustment (QTA) for 2QFY25 was finally notified, with an unusual lag of over two months. Now that it is here and is to be applied to all consumer categories barring lifeline, it adds another Rs1.9/unit to the relief for the quarter beginning April 2025.

Then comes the Fuel Charges Adjustment (FCA), which for April 2025 turns out to be negative Rs1.36/unit – and is lower than last month’s adjustment of negative Rs2.12/unit. Essentially, the net impact of FCA month-on-month is unfavorable and does not add to the relief via QTA and TDS. There is also a one-time element of negative Rs0.9/unit in the FCA – which the regulator has allowed to be passed on to consumers for three months – on top of the regular FCA, which will be heard and decided upon for May and June when due.

Given the worryingly lower hydrology owing to an unusually dry season, authorities have already warned of FCA turning positive again in the coming months – and that could lower the absolute impact even further. Even if one assumes the April FCA to hold firm for May and June, the combined benefit ranges from Rs3.4/unit to Rs4.3/unit across consumption slabs after accounting for surcharges, duties, and taxes. With taxes or without, with surcharges or without – the net impact does not come anywhere close to Rs7/unit.

A few numbers have been floated—Rs1.5 to Rs2 per unit in additional relief—credited to the IPP renegotiations. Sounds generous. Except it’s deja vu in disguise. The supposed windfall from capacity payment savings is already baked into the hefty negative QTA adjustment for 2QFY25. It’s not a cherry on top - it’s the cake itself.

Unless the government is hiding a second act it hasn’t yet presented to Nepra (and the audience), there’s little basis for this bonus round of relief. As it stands, the overall price cut falls well short of the grand narrative being spun. Let’s just say the scriptwriters got a little carried away.

It remains to be seen if the government has the financial room to continue with the additional R1.7/unit TDS beyond June 2025 – but for now, the relief is temporary, as per the government’s own prayer to the regulator. The periodic quarterly and monthly adjustments are a regular occurrence with varying degrees of change – depending on a number of factors – and not much can be rested on it for FY26 and beyond.

Mind you, Pakistan, in consultation with the IMF, is on a path to undertake cost-side reforms in the energy sector. The next base tariff decision is due in July 2025, and discos have only just started to submit indexation requests for FY26. The first petition in this regard from one of the best-performing discos, i.e., IESCO, shows average Power Purchase Price and Distribution Margin leading to a tariff closer to Rs40/unit.

One hopes that this does not come to pass, as base tariff assumptions, particularly, as regards fuel prices, warrant a significant downward revision. With the Neelum Jehlum hydel plant already out of equation, the impact of gains from IPP negotiations could well be diluted in the upcoming base tariffs, and the monthly adjustments could be back to the positive territory – as warned by close observers of late.

What is also clear is that there appear to be no plans to withdraw the plethora of various surcharges on electricity consumption anytime soon. If anything, the media has been fed with news that suggests additional surcharges on top of the already exorbitant ones. All this while, grid demand has continued to fall and won’t miraculously revive itself – unless more meaningful reforms are undertaken in distribution, transmission, and net-metered segments.

Be that as it may, the relief is a welcome respite to all consumer categories, where prices have doubled in less than three years in most cases. It should not be mistaken for ‘reform’. It is a temporary relief and should be termed as such. And that, too, correctly.

Comments