PSX sheds over 1,300 points amid global market slump

- Negative sentiment returns to Pakistan Stock Exchange

Negative sentiment returned to the Pakistan Stock Exchange (PSX), tracking a global market slump, as the benchmark KSE-100 Index shed over 1,300 points on Friday.

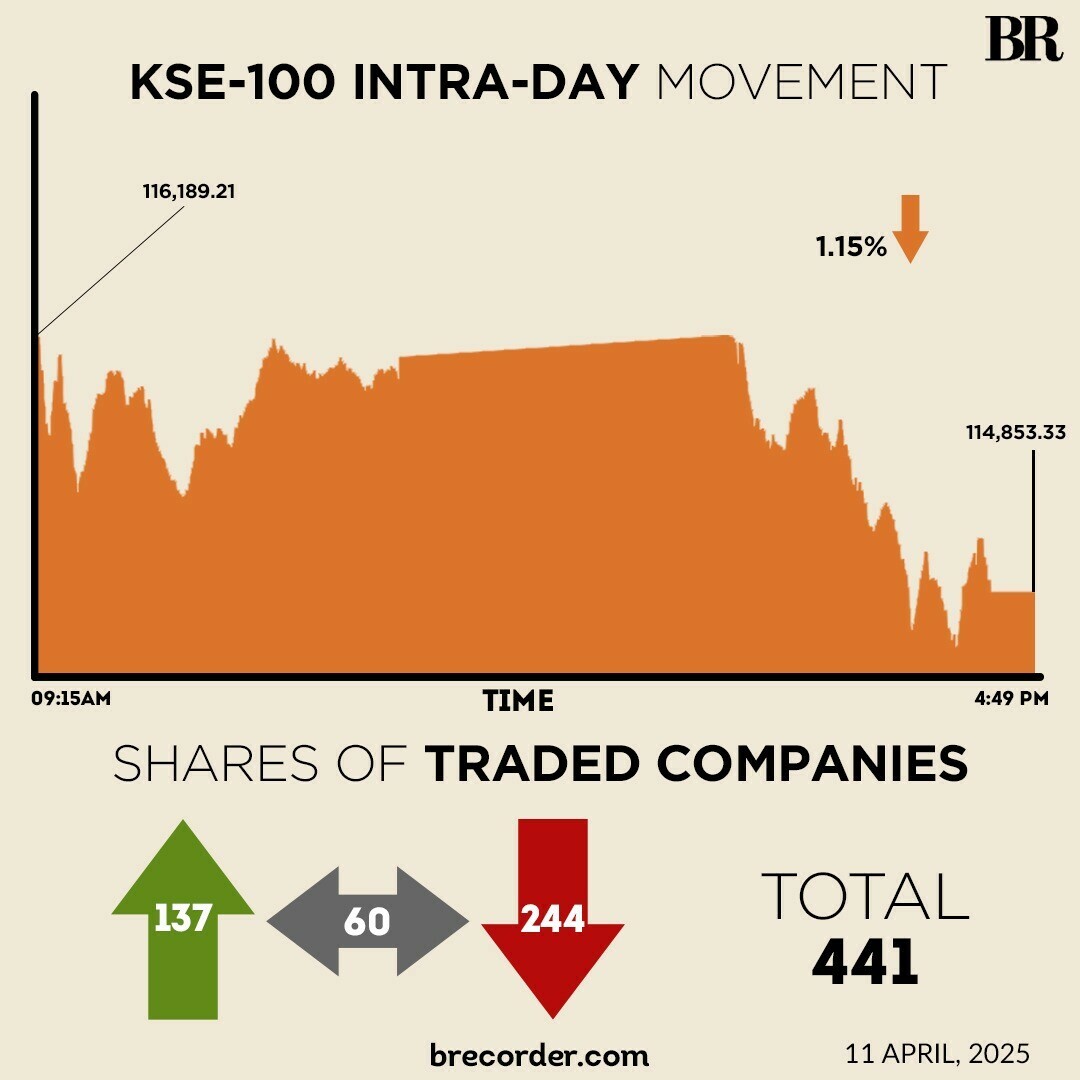

The KSE-100 witnessed range-bound trading in the first half, but the second-half of the session saw strong selling pressure that pushed the index to an intra-day low 114,639.92.

At close, the benchmark index settled at 114,853.33, down by 1,335.88 points or 1.15%.

Earlier, selling pressure was observed in key sectors including automobile assemblers, commercial banks, oil and gas exploration companies, OMCs, power generation and refineries. Index-heavy stocks including MARI, OGDC, PPL, POL, PSO, SNGPL, HUBCO, MEBL, NBP and MCB traded in the red.

Pakistan has expressed reservations over the broader consequences of controversial US tariff policies on global trade, particularly their adverse effects on developing economies.

At his weekly media briefing on Thursday, Foreign Office Spokesperson Ambassador Shafqat Ali Khan stressed the consistent nature of global commerce and called for a swift and mutually beneficial resolution.

On Thursday, PSX closed higher, supported by gains in regional capital markets after US President Donald Trump announced a 90-day pause on tariffs.

Internationally, global stocks slumped and the dollar sank further on Friday, while a manic bond selloff took hold in a brutal end to the week of tit-for-tat worldwide tariffs that have fed fears of a deep recession and shaken investor confidence in U.S. assets.

The anxiety has sparked a rush into safe havens, sending the Swiss franc soaring to a decade high against the dollar, and gold to a new peak after a brief but massive relief rally following U.S. President Donald Trump’s move to temporarily lower tariffs on many countries.

The selloff in US Treasuries picked up pace during Asian hours, with the 10-year note yield rising to 4.475%, gaining over 40 basis points in the week, the biggest increase since 2001, LSEG data showed.

Analysts and investors across the globe have pointed to this week’s sharp sell-off in Treasuries and weakness in the dollar as evidence that confidence in the world’s biggest economy has been shaken.

In Asia, Japan’s Nikkei tumbled 4.5% on the day, while stocks in South Korea fell 1.7%. MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.5% lower.

US futures for S&P 500 and Nasdaq fell about 1% each after a sharp drop overnight.

Investors are grappling with worries over the escalating Sino-US trade war after Trump ratcheted up tariffs on Chinese imports, raising them effectively to 145%.

China has hit back, hiking its tariffs on the U.S. with each Trump increase, raising fears that Beijing may jack up duties above the current 84%.

Meanwhile, the Pakistani rupee saw slight improvement against the US dollar, appreciating 0.03% in the inter-bank market on Friday. At close, the currency settled at 280.47, a gain of Re0.09 against the US dollar.

Volume on the all-share index decreased to 458.59 million from 638.09 million recorded in the previous close.

The value of shares declined to Rs31.63 billion from Rs36.92 billion in the previous session.

Pak Elektron was the volume leader with 40.74 million shares, followed by Sui South Gas with 38.08 million shares, and B.O.PunjabXD with 33.17 million shares.

Shares of 441 companies were traded on Friday, of which 137 registered an increase, 244 recorded a fall, while 60 remained unchanged.

Comments