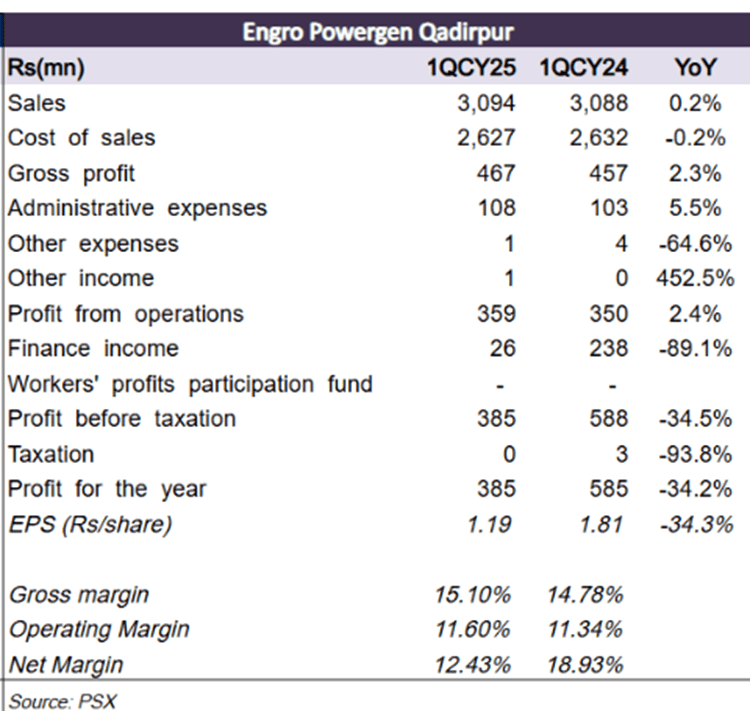

Engro Powergen Qadirpur Limited (EPQL) delivered a mixed performance in 1QCY25, with earnings per share down 34 percent year-on-year, despite a quarter-on-quarter recovery due to prior quarter provisioning for late payment surcharge (LPS). The company announced a record interim dividend of PKR 7.50 per share during the quarter, largely facilitated by the long-awaited recovery of outstanding receivables under an amended agreement. The company’s sales growth was flat, while the gross profit in 1QCY25 was up 55 percent from the previous quarter and 2 percent year-on-year, aided by higher utilization in March and improved O&M cost efficiencies. However, finance income declined sharply by 89 percent year-on-year and 105 percent quarter-on-quarter as overdue receivables reduced and LPS was waived. Nonetheless, EPQL posted a decline in net earnings for 1QCY25 due to higher administrative expenses.

Looking back at CY24, the company posted net sales of Rs13.2 billion, flat from the previous year, while profit after tax declined 15 percent year-on-year. The earnings contraction was primarily due to a significant jump in other expenses, which surged 13 times. During the year, total power generation stood at 847 GWh, reflecting a load factor of 45 percent, slightly lower than 46 percent in CY23. One of the most consequential developments was the amendment to the Power Purchase Agreement (PPA), transitioning EPQL to a ‘take-and-pay’ model from November 2024. Under the revised terms, the minimum billable capacity factor was reduced to 35 percent from 100 percent in return for the waiver of overdue LPS liabilities.

Also, NEPRA approved a modification to EPQL’s generation license, allowing the company to source gas from the Badar Gas Field, operated by Petroleum Exploration Limited (PEL). With this addition, EPQL’s merit order ranking is expected to improve. Meanwhile, management is exploring further diversification of fuel sources.

Despite concerns over the shift to the take-and-pay regime and its potential impact on long-term earnings and valuations, EPQL’s improved receivables position and bumper payouts offered a short-term cushion for investors. That said, downside risks remain, including declining imported coal prices and the implementation of WACOG (weighted average cost of gas), which could challenge EPQL’s competitiveness.

Comments