BUDAPEST: Central European government bonds and currencies regained some ground on Thursday as a rally in US Treasury bond yields and the dollar lost steam and the European Central Bank kept policy on hold.

BUDAPEST: Central European government bonds and currencies regained some ground on Thursday as a rally in US Treasury bond yields and the dollar lost steam and the European Central Bank kept policy on hold.

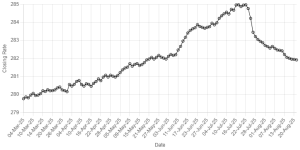

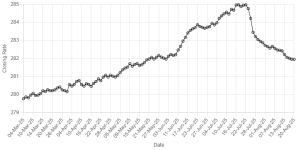

In the past few days, regional currencies and bonds hit multi-week lows and equities have weakened as the US 10-year yield reached four-year highs and the dollar firmed.

But the US yield retreated below the key 3-percent line on Thursday and the euro reversed its slide against the dollar as ECB President Mario Draghi played down concerns over recent soft euro zone economic data.

The ECB's decision to keep rates on hold and its comments did not surprise most market participants.

Central Europe's most liquid currencies, the zloty and the forint firmed against the euro even before the ECB meeting and were stronger by 0.1 percent at 1344 GMT.

Poland's 10-year government bond yield dropped 4 basis points to 3.065 percent and its Romanian peer was bid lower by 6 basis points at 4.59 percent.

Hungary lifted its offer by almost 50 percent at Thursday's auctions, selling bonds near secondary-market levels.

"The (government debt agency) AKK was happy, selling 100 billion forints worth of bonds at these yields, aware that yields will be much higher in the second half of the year," one Budapest-based fixed income trader said.

The Hungarian central bank's first comments since Prime Minister Viktor Orban's Fidesz party was re-elected on April 8 confirmed that no change is expected in ultra-loose monetary policy, another trader said.

Deputy Governor Marton Nagy told Reuters the bank was relaxed about domestic inflation trends and was unlikely to start tightening up its easy monetary policy before the ECB begins raising rates.

"It is more likely that the NBH will take any steps only after the ECB moves," he said.

The Serbian central bank continued to buy euros on the market to stem gains in the dinar which is trading near four-year highs against the euro even though the bank has cut interest rates twice in two months.

Regional equities were mixed and mostly rangebound.

Bucharest's index, retreated from a new 10-year high it had reached, helped by lucrative dividend payments by some listed companies.

Czech broadcaster CME's shares gained almost 3 percent after it announced a new financing deal and a rise in core profits.

Comments

Comments are closed.