The Brazilian government is creating a department to foster relations with and explain policy moves to market participants, a source with direct knowledge of the plans said on Friday, after almost four years of confusing economic policy steps. The creation of an investor relations office aims to align broader policy goals with those of entities under the umbrella of Brazil's finance ministry, such as the National Treasury and the tax authority, said the source, who declined to be identified because the decision has not been made public.

Top officials in President Dilma Rousseff's administration are aware that business leaders and investors are wary of government actions, partly due to mixed fiscal and monetary policy signals, the source noted. "The government needs to improve its communication channels with the markets," the sources noted. By seeking to unify its policy speech and deliver it in a uniform way, the government is seeking to mitigate any potential volatility on the road to the October presidential election. Rousseff is expected to run for a second, four-year term.

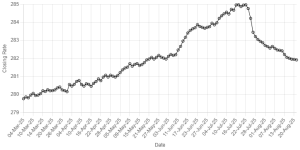

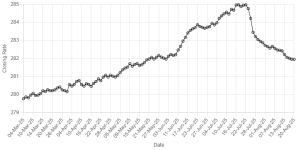

Over the past three years, Brazil's local stock market, mergers and acquisitions deals and stock offerings have suffered, partly due to eroding confidence in Rousseff's handling of the economy as growth slowed and inflation quickened. Political wrangling ahead of the election as well as Rousseff's tendency to meddle excessively in the economy has hurt investor confidence, investors and analysts including Tony Volpon of Nomura Securities have said. Yet in recent months, signs of a more business-friendly economic policy framework has emboldened investors and bankers. President Dilma Rousseff's push to woo investment in infrastructure is fanning optimism that interference will wane.

BR100

15,115

Increased By

28.1 (0.19%)

BR30

43,048

Increased By

175.6 (0.41%)

KSE100

149,493

Increased By

257.8 (0.17%)

KSE30

45,518

Increased By

11.6 (0.03%)

Comments

Comments are closed.