A senior official at investment management firm PIMCO said on Wednesday the South Korean won would remain under pressure for some time and that the country's central bank would likely cut interest rates further. "I would be very surprised to see the Korean currency keep on strengthening over the next 12 to 18 months," Luke Spajic, head of PIMCO's emerging markets Asia portfolio management, said in response to a question at a conference in Seoul.

He said the won's weakness would be due mainly to an anticipated strength in the US dollar for the coming months on the back of the US economy's solid performance coupled with policy easing in Japan and Europe. South Korea's central bank cut the policy interest rate three times since May last year, including a cut in October, by a total of 75 basis points to 2.0 percent that matches a record low.

BR100

16,313

Increased By

5.8 (0.04%)

BR30

52,359

Increased By

821.6 (1.59%)

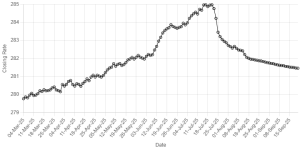

KSE100

158,037

Increased By

83.9 (0.05%)

KSE30

48,251

Increased By

52.4 (0.11%)

Comments

Comments are closed.