Arabica coffee futures recovered on Monday after being pushed to a 5-1/2-month low by a stronger US dollar, while raw sugar gained ground from a 3-month trough, pressured by hefty stocks and weak oil prices. Cocoa futures firmed on chart-based buying as trading picked up after the New Year holiday, with dealers focused on the pace of bean arrivals at ports in West Africa.

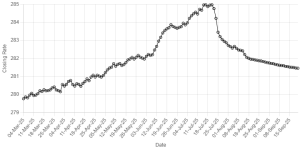

The front-month March arabica coffee contract rose 4.15 cents, or 2.6 percent, to $1.6520 cents a lb on chart-based buying, after earlier falling to $1.6010, the contract's lowest level since mid-July. "It's a technical correction, reinforced by the fact that people are back from their holidays," a broker said. Second-month May arabicas rose 4.35 cent or 2.7 percent to $1.6810 per lb.

"Further selling pressure could see losses extend back down towards $1.60 per lb, while protracted declines would then look to test levels around $1.55," said Kash Kamal, research analyst with Sucden Financial, referring to the second-month contract. March robusta coffee rose $23, or 1.2 percent, to $1,887 per tonne. Raw sugar futures firmed after touching a 3-month low, pressured by the strong dollar, weak Brazilian real currency and a slippage of oil prices to a 5-1/2-year low. Weak oil prices make cane-based ethanol less competitive.

"I think there are more bearish signals in the market than bullish ones," said Claudiu Covrig, senior agricultural analyst with data provider Platts Kingsman. "Mills are encouraged by the strong dollar to produce." A strong dollar boosts returns in local currencies from dollar-denominated sales by mills in key producers such as Brazil.

A broker said weakness in the real currency had triggered Brazilian producer selling. "The general expectation is that the real will continue to weaken in the near term with a price target of 2.80-3.00 (to the dollar)," the broker added. Front-month raw sugar firmed 0.08 cent, or 0.6 percent, to 14.25 cents a lb, after earlier falling to 14.07 cents, a 3-month low basis front month. March white sugar traded up $0.60, or 0.2 percent, at $379.70 per tonne. New York March cocoa firmed $18, or 0.6 percent, to $2,945 per tonne. London May cocoa gained 20 pounds, or 1 percent, to trade at 1,979 pounds per tonne.

BR100

16,313

Increased By

5.8 (0.04%)

BR30

52,359

Increased By

821.6 (1.59%)

KSE100

158,037

Increased By

83.9 (0.05%)

KSE30

48,251

Increased By

52.4 (0.11%)

Comments

Comments are closed.