If media reports are any guide, a recent study on mobile and internet access in Pakistan, conducted by LIRNEasia a “pro-poor, pro market” Colombo-based think tank, has not been taken too favourably by local stakeholders, market players and regulator alike. And that’s quite understandable.

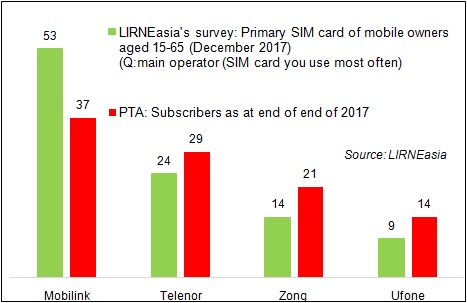

In the case of cellular SIM market shares, all but one telecom operator would be happy with the study’s findings. The regulator, Pakistan Telecommunication Authority (PTA), on the other hand does not reportedly agree because the study puts Pakistan’s tele-density at 58 percent, whereas the PTA had put that number at north of 72 percent in December 2017, when LIRNEasia’s nationally representative sample-based survey had ended.

The devil, however, lies in the details, the kind of details that have been published by LIRNEasia in its report titled “AfterAccess: ICT access and use in Asia and the Global South”. The key difference between LIRNEasia’s findings and that of PTA is that the former is looking from the demand-side, measuring households and individuals, and counting one subscription as one user even if they hold more than one SIMs, whereas the latter looks from the supply-side counting active SIMs without regards to multiple SIM holders.

If the PTA, a Board of Investment official or anyone else wants to make a sales pitch at a Pakistan investment roadshow abroad, PTA’s number becomes relevant: 72 percent is a good sell than 58 percent. But if they really want to get the policy right at home, then the number of unique users is a better way to measure tele-inclusion, which by the way, in the wake of growing branchless banking, also offers a journey towards financial inclusion. Factoid: according to the study, 23 percent of mobile phone owners in Pakistan (between 15-64 age) have two or more SIMs.

Being estimations based on sample-based survey, such findings are not always written in stone. There is always a slippage or two, due to which findings may be far off from reality. But that only points to the need to produce more of such research and generating a discourse around those findings because the information and lessons gleaned from such surveys can have implications for both policy wonks as well as businesses.

Consider for example the study’s finding that 69 percent of non-Internet users (between 15-65 age) in Pakistan don’t use the Internet because ‘they don’t know what Internet is’. This has a policy implication: the need to increase net literary. Or consider that only 14 percent of Internet users in Pakistan are aware of the opportunities to buy and sell goods over internet via laptop, computer, or mobile app. For e-commerce players, this finding could either be discouraging or help them devise appropriate advertisements.

Instead of shooting down the research produced by contrarians, the PTA and local market players would do well to fund, if not conduct their own research on the granular level information about voice and data SIMs and their usage. This information should pertain to urban-rural gap, gaps between rich & poor, and men & women, types & frequency of usage, province-wise usage patterns, and so forth – a host of which are covered in LIRNEasia’s study.

In fact, as BR Research has previously argued, at least some critical telecom, mobile data, and mobile money related fields should be added in PSLM and HIES surveys conducted by the Pakistan Bureau of Statistics (PBS). Accordingly, public dissemination of such studies whether by PTA, mobile operators or the PBS, is equally important both for policy discourse and business decisions, especially in the wake growing trends towards start-up culture, financial inclusion, and e-commerce.

Comments

Comments are closed.