Engro Polymer & Chemicals Limited

A subsidiary of Engro Corporation Limited, Engro Polymer & Chemicals (EPCL) was incorporated in 1997. Its primary business is within the chlor-vinyl segment, which includes Polyvinyl Chloride (PVC), Vinyl Chloride Monomer (VCM), Caustic Soda, Hydrochloric Acid and Sodium Hypochlorite.

Caustic soda is used mostly for the dyeing and mercerizing in textile. It is also used for FFA removal from edible oil and ghee, soap and water purification. Sodium hypochlorite is used for the purposes of water treatment, detergents, denim bleaching and paper bleaching. Hydrochloric acid is used for pickling, oil well acidizing, water treatment, cleaning, food processing and medicine and hydrogen is used for the manufacture of terephthalic acid.

Though EPCL manufacturers and markets products for a range of industries, its primary commodity is PVC for which it is the sole producer in Pakistan. In the domestic market, it is used mostly to manufacture PVC pipes, but its other uses include artificial leather, shoes, garden hose, windows and doors. PVC demand is mostly influenced by the level of construction in the country.

EPCL recently announced plans to invest Rs 10 billion to increase capacity of VCM (raw material for PVC), PVC, caustic soda and upgrade its power plant. The bulk of this expansion will be through issuance of right shares of approximately Rs 5.4 billion and Rs 2.2 billion is expected to be raised through debt, which will raise its finance costs.

Financial overview

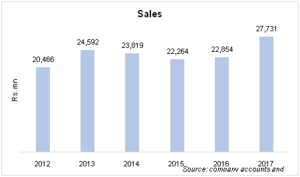

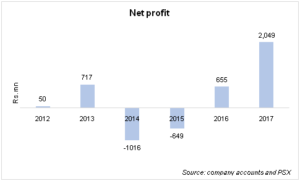

EPCL has faced a few difficult years with a squeezed bottom-line and losses in 2014 and 2015. In 2012, PVC margins were under pressure due to lower international demand as the economies in Europe, China and India slowed down. This led to lower PVC prices whereas ethylene prices were high because of unrest in the Middle East, which fueled uncertainty of crude oil supply. 2013 was a better year for EPCL with the company posting highest profits ever before the losses of 2014 and 2015.

The losses were due to unanticipated drops in margins, lower sales of caustic soda and increase in the price of natural gas. To manage the cash flow requirements, EPCL got long term financing from its parent company Engro Corp. Since 2016 however, its performance has improved with 2017 witnessing a significant up tick in profits.

CY17 performance

The last financial cycle saw the highest turnover and profits in EPCL's history with the bottom-line increasing by triple digits. The impetus for the growth started at the top with an 11 percent increase in PVC prices during the year to $1161 per ton.

Higher prices were partly due to the impact of Hurricane Harvey that closed down plants in Texas, the petrochemical hub of the United States. The decrease in global PVC supply led to a rise in prices, which EPCL was able to capitalise on. Furthermore, as a result of de-bottlenecking activities, production rose by 17,000 tons that was consumed by increase in downstream demand. Higher price and higher volume led to the 21 percent increase in sales.

Increase in gross profit margin was due to the higher spread between PVC and ethylene. While EPCL was able to reap fruits of higher international PVC prices, the higher international ethylene prices did not significantly impact the company since it imports ethylene from regional countries. The increase in gross profit margin was able to tickle down to net profit, which was not materially impacted by exchange rate losses due to devaluation of currency and higher oil prices that increased distribution expenses.

Future outlook

There is a strong demand in the construction sector in Pakistan with planned investments in infrastructure projects, spending of Public Sector Development Program and CPEC operations under way. EPCL has estimated that with rising PVC demand, market size rose by 33 percent and is expected to continue to grow.

Though CPEC is one source of growth, the main source of rising PVC consumption is housing. Due to the rapid pace of urbanization and setting up of projects such as Bahria Town Karachi, it is expected that PVC demand will rise. These factors are expected to continue being catalysts for Engro Polymer growth.

On the other hand, EPCL will always be subject to volatility in international commodity prices, especially ethylene on which PVC production depends. Furthermore, it faces the threat of dumped imports of PVC as its tariff protection is on an interim basis. In its caustic soda segment it faces fierce competition because the market is oversupplied and has been so for the last few years.

Keeping these challenges aside, the prognosis of EPCL is highly positive. Pakistan's PVC per capita consumption is the lowest in the region at 1.03 whereas India's is 1.7 kg. The company views this as a positive sign indicating that there is a lot more room for growth, hence its recent investment and expansion plans.

======================================================================= Engro Polymer & Chemicals Limited ======================================================================= Rs. (mn) CY17 CY16 YoY ======================================================================= Net revenue 27,731 22,854 21% Cost of sales -21,665 -18,919 15% Gross profit 6,065 3,935 54% Distribution and marketing expenses -1,318 -1,180 12% Administrative expenses -584 -519 13% Other operating expenses -365 -149 145% Other income 133 20 565% Operating profit 3,930 2,107 87% Finance costs -821 -927 -11% Profit before taxation 3,109 1,180 163% Taxation 1,060 252 321% Profit for the year 2,049 655 213% Earnings per share - basic and diluted 3.09 0.99 21,200bps Gross profit margin 22% 17% 2,700bps Net profit margin 7% 3% 15,800bps =======================================================================

Source: PSX

============================================================================= Pattern of shareholding (as at December 31 ,2016) ============================================================================= Category No. of share % ============================================================================= Directors, CEO, Spouse, and minor children 5,010 0.00% Associated companies, undertaking and related parties 538,955,827 81.23% Banks, DFIs, Non-Banking Financial Institutions 161,000 0.02% Insurance companies 1,225,000 0.18% Modarabads and Mutual Funds 4,780,000 0.72% ----------------------------------------------------------------------------- General public ----------------------------------------------------------------------------- a. Local 91,995,710 13.87% b. Foreign - 0% Others 26,346,241 3.97% Shareholders holding 10% Engro Corporation Limited 372,809,989 56% International Finance Corporation 97,155,000 15% Mitsubishi Corporation 67,949,998 10% =============================================================================

Source: Company accounts

Comments

Comments are closed.