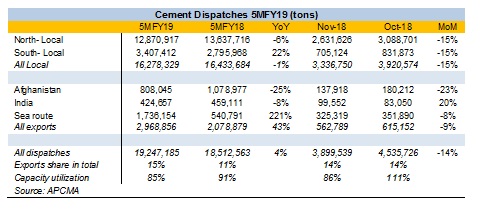

Sea-borne cement exports are breaking all kinds of ceilings, growing by more than 200 percent in 5MFY19. It seems that the industry has managed to explore new markets seeing as exports to Afghanistan have considerably waned and the Indian market is also proving to be difficult ((read: “’Concrete’ plans”, Aug 27, 2018). The industry has been banking on local demand, which much to the chagrin of its champions has remained lethargic. Cumulatively, cement dispatches have grown slightly, bolstered by exports revival and local demand in the south. The north zone disappoints.

Four expansions have already come through (Lucky, DGKC, Bestway and Attock), and another 20 million tons will be added by FY21. Despite these planned expansions, the department of Industries, Commerce and Investment (IC&I) will soon be notifying the rules for investments into new cement plants; the Chinese are showing interest. Apparently, the 73 million tons of cement capacity over the next two years will not be enough. What’s driving this optimism that latest numbers are not reflecting at all?

Organic demand of cement coming from housing and real estate commercial development may see a dip as cost of borrowing increases. On the flip side, the expected CPEC/PSDP infrastructure overhaul is still on track which means the demand for cement in that area will remain consistent. Evidently, the increased excitement comes from the ambitious Naya Pakistan Housing Program. Though the framework has not yet been decided, the plan has an elusive allure for developers, architects, and suppliers of construction materials like cement, not to mention certain banks who might be open expanding their mortgage coverage.

Estimations made by BR Research suggest: if one million houses are constructed each year in the country, the additional demand for cement could be 22 million tons. This is based on rough estimations assuming each house is 1000 sq.ft, and for each house of that size, a typical average of 400 cement bags are used. It’s unclear what kind of housing will come under this plan—whether it would be vertical or horizontal, whether it would cater to low-income groups specifically or not, let alone the mechanics and the size/dimensions of the construction. At this point, we know very little of the where, how, when. However, there is no doubt that it will provide a huge impetus to the industries, of which cement will take center stage.

What’s also clear is that the hike in interest rates, reinstatement of the restriction on non-filers to purchase property, and economic slowdown may affect demand in the short term. The Supreme Court recently removed the ban on high rise construction in Karachi which may revive some of the real estate activity in the metropolis.

Continued rupee depreciation, increased price competition (especially in the north markets) as new expansions come through and utilization dips, and rising costs of imported fuels like coal will together determine where the industry stands in terms of profitability. So far, it’s a somber outlook on that front.

Comments

Comments are closed.