Nishat Chunian Limited (PSX: NCL) has grown from its humble origins of a spinning mill comprising of 14,400 spindles to become the fourth-largest textile company by sales. The company has managed to become a vertically integrated unit with annual spinning production of 75,000 tons of yarn, 3 million metres of greige fabric in weaving and 4 million meters of finished fabric.

Apart from textiles, the group also entered the power sector in 2007 by setting up a 200 MW power plant to cater to the rising energy demand. Venturing into entertainment sector, NC Entertainment was founded in 2015 to further diversify business interests.

As of now, Nishat Chunian Group consists of five companies which include Nishat Chunian Power Limited (a power generation company), Nishat Chunian USA Inc. (Incorporated in USA), Nishat Chunian Electric Corporation Ltd.(a captive power generation company), apart from the textile and entertainment companies mentioned above.

Stock & pattern of shareholding

NCL's stock price has been closely trailing the benchmark KSE-100 index since Nov-17 while briefly outperforming it for two month period before that. The stock paid a dividend of Rs 2.75 in FY17 which translated into a dividend yield of 5.8 percent. NCL is currently trading at a trailing P/E multiple of 6.3 times. The pattern of shareholding shows that NCL's majority shareholding lies with the general public. The second-largest is with associated companies. Shahzad Saleem, CEO of the company owns 11.62 percent of the company while Nishat Mills Limited (NML) owns 13.61 percent.

Prior performance

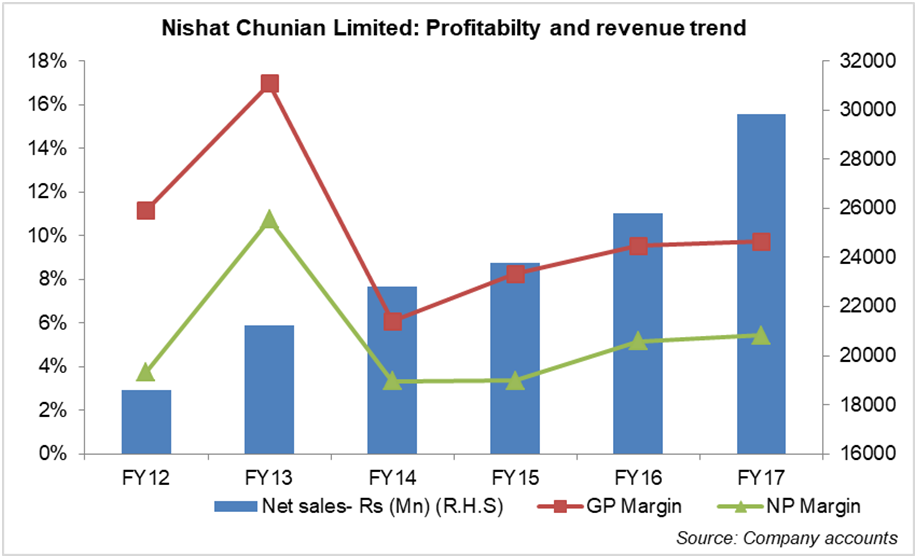

NCL has managed to maintain its top-line growth trajectory over the past several years while margins have tended to fluctuate in comparison. FY13 was a good year for the company in light of the dollar appreciation, good contribution from the yarn segment while also implementing cost-minimization.

But FY14 was an entirely different story where NCL saw margins drop on account of several factors which included rising expenditures and intense competition in the global markets which led to unutilized capacity in the spinning segment. Exchange rate fluctuations were also unfavourable taking a toll on margins.

In FY15, the demand for textile products in general and cotton yarn in particular declined, with a Rupee appreciation further hurting the company's margins. However, the subsequent year was definitely stolen by strong performance from the home textile division while the company was also able to undertake further cost rationalization.

When talking about Nishat Chunian's bottom-line, however, it becomes pertinent to mention the huge role played by 'other income,' which has often times been higher than the bottom-line itself! This is mostly in the form of dividend income from one of its subsidiary companies, Nishat Chunian (Power) Limited.

FY17 saw profitability grow in light of the investment on BMR activities and the shining performance of the Home Textiles Division which managed to augment its exports. According to the Director's report NCL invested almost Rs 2.754 billion in capacity addition and modernization. The bulk of this went to the spinning division with an investment of Rs 1.914 billion resulting in an addition of 53,664 spindles out of which 40,608 were replacements.

Segment-wise, constitutes the largest chunk of NCL' revenue, followed by processing & home textile, and then weaving. Seemingly, the sales mix has not changed much over the years, as spinning has accounted for 54-60 percent of sales over the past five years, while processing has remained around 29-31 percent. However, for FY17, the home textile's division contributed 29 percent to the top-line which might be indicative of a gradual shift in the sales mix.

Being primarily an export-oriented company NCL earns roughly 69 percent of its revenues from exports. In terms of segments, the home textile segment earns the highest foreign exchange (93% of its sales are exports), while both spinning (57%) and weaving (37%) have a relatively stronger domestic presence. However, the company has taken steps to increase the home textile segment's domestic market share by launching "The Linen Company" to enter the retail space in Pakistan which has been doing well.

Recent performance

Taking a look at the 9MFY18 period, NCL managed to grow its top-line by almost 17 percent with a proportionate change in its COGS thereby keeping gross margins intact at 10 percent. The increase in revenue is mainly attributable to the surge of yarn sales in the local market. The gross profit grew by 16 percent on a year on year basis whereas operating profit witnessed negligible change.

The stagnation in operating profit might be explained because of the higher cotton prices during the period. Rising utility costs also put pressure on profitability. The company managed to reduce its other operating expenses by almost 58 percent but its other operating income slid by almost 31 percent which put pressure on the bottom-line. This fall in non-core income is mostly attributable to the lack of dividends paid by its subsidiary, Nishat Chunian Power Limited. Recall that power sector firms including Nishat Power Limited (NPL) have not paid dividends this year so far on account of liquidity constraints due to non-payment of dues by NTDC.

The finance cost has also picked up by 27 percent in the 9MFY18 period on a year-on-year basis which is reflective of increased borrowing to fund both capex and working capital requirements which in particular included sizeable purchasing of raw material. NCL's long term financing has increased by 18 percent whereas short term borrowings have risen by 12 percent as compared to 9MFY17.

Future outlook

NCL has started operations of the 99 looms that it acquired last year to revive one of its defunct spinning units while it has also invested Rs 340 in its dyeing and printing unit.

The company's investment in BMR will result in enhanced productivity going forward. The company is also expanding its retail footprint by opening outlets of its flagship store "The Linen Company" in Rawalpindi and other cities as well.

The company is also set to benefit from the depreciation of the rupee against the dollar and euro makings its exports more competitive in international markets.

============================================================================== Nishat Chunian Limited ============================================================================== Rs (Mn) 9MFY18 9MFY17 YoY 3QFY18 3QFY17 YoY ============================================================================== Sales 25,740 22,069 17% 8,903 7,619 17% Cost of sales 23,121 19,803 17% 7,669 6,750 14% Gross profit 2,620 2,266 16% 1,235 869 42% Distribution expenses 663 560 18% 232 201 15% Administrative expenses 162 156 4% 57 62 -8% Other operating expenses 60 144 -58% 36 28 29% Other operating income 728 1,062 -31% 249 34 632% Profit from operations 2,463 2,468 0% 1,159 613 89% Finance cost 1,008 791 27% 370 298 24% PBT 1,455 1,677 -13% 789 315 150% Taxation 251 276 -9% 77 39 97% PAT 1,203 1,401 -14% 711 276 158% EPS (Rs) 5.01 5.83 -14% 2.96 1.15 157% Gross margin 10.2% 10.3% 13.9% 11.4% Net margin 4.67% 6.35% 7.99% 3.62% ==============================================================================

Source: Company accounts

==================================================================== Pattern of Shareholding ==================================================================== Shareholders Category Percentage of holding ==================================================================== Directors, CEO, their spouses and minor children 14.18% Executives 0.00% Associated Companies, Undertakings & Related Parties 16.64% Public Sector Companies & Corporations 0.00% NIT and IDBP (ICP UNIT) 0.00% Banks, DFIs, Non-Banking Financial Institutions 10.29% Insurance Companies 2.72% Modarabas and Mutual Funds 4.52% Joint Stock Companies 13.15% Others 0.89% General Public 37.61% ====================================================================

Source: company accounts

Comments

Comments are closed.