China's yuan weakened on Friday as surprisingly strong export figures fed fears over its trade war with the United States, while most other Asian currencies firmed on Friday after being battered earlier in the week by fallout from a global equity market sell-off. US Treasury bond prices rose overnight as investors flocked to safety, pushing down yields. The falling yields, and a smaller than expected rise in US consumer prices helped push the dollar near its weakest level this month against a basket of six major currencies, and gave emerging market currencies some relief.

The Indian rupee, Asia's worst performer this year, strengthened 0.7 percent to 73.608, coming just a day after it set yet another record low against the dollar.

Indian inflation figures out later are expected to show consumer prices rose 4 percent in September, up from Augusts' 3.69 rise, and bang on the central bank's medium-term target of 4 percent.

The rupee was set to snap six weeks of straight losses, helped by oil prices coming off recent highs and looking on course to shed 4 percent this week.

But the currency remains hampered by India's large current account deficit, and the central bank's apparent hesitancy raising interest rates.

South Korea's won gained over 1.3 percent to 1,130.2 per dollar.

The unemployment rate in the country fell in September, after setting an eight-year high in August.

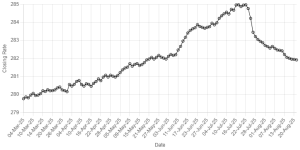

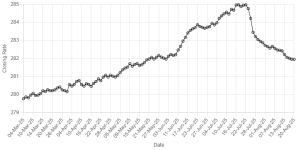

The yuan was trading 0.1 percent weaker against the dollar at 6.896, halting three sessions of gains, as unexpectedly strong China exports fueled worries that an escalation in the Sino-US trade war would continue.

September exports rose 14.5 percent from a year earlier, Chinese customs data showed.

That blew past forecasts for an 8.9 percent increase in a Reuters poll and was well above August's 9.8 percent gain.

It comes a day after US President Donald Trump warned that there was much more he could do that would hurt China's economy.

The data might offset reports on Thursday that the US Treasury staff had not labelled China as a currency manipulator in its recommendation for the department's semi-annual report on foreign exchange rate practices.

Still,, the yuan appears set to weaken against the dollar for a second week, largely as a result of the sharp decline suffered at the start of the week in reaction to the central bank cutting the amount of cash that banks must hold as reserves.

The Monetary Authority of Singapore (MAS) tightened monetary policy for the second time this year, increasing the S$NEER slope from 0.5 percent to 1 percent, supporting a 0.2 percent gain in the city-state's dollar to 1.374 per US dollar.

Analysts viewed today's decision as hawkish as the MAS downplayed trade frictions and was upbeat about economic activity.

The MAS expects inflation pressures from higher oil and food prices as well as an improving labour market.

"MAS is not yet done with policy normalisation, and a further increase in the S$NEER is likely if the economy evolves as the MAS expects," said Khoon Goh, Head of Asean Research at ANZ.

Mizuho bank analysts on the other hand, cautioned that downside risk cannot be ignored and "the real issue is whether the evolving US-China trade spat and/or global liquidity mop up inadvertently result in an abrupt buckle in economic activity."

BR100

15,115

Increased By

28.1 (0.19%)

BR30

43,048

Increased By

175.6 (0.41%)

KSE100

149,493

Increased By

257.8 (0.17%)

KSE30

45,518

Increased By

11.6 (0.03%)

Comments

Comments are closed.