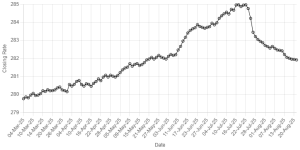

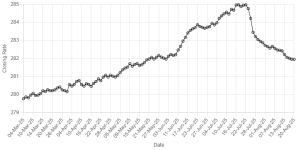

China's growth downshifted in the third quarter as investment slowed and the widening trade conflict with the United States weighed on sentiment, according to analysts surveyed by AFP. The world's second largest economy expanded by 6.5 percent in the July to September period, the poll of 12 economists found ahead of the official release of gross domestic product figures on Friday.

The sluggish growth would mark China's slowest pace of expansion since the first quarter of 2009, when the financial crisis battered global markets and knocked China's export machine.

The trade row with the US comes at a tough time for China's economy, which has been hit by the government's efforts to tackle a mountain of debt, with credit for local governments and state-owned enterprises tightening and infrastructure investment declining. The third quarter forecast is down from 6.8 percent and 6.7 percent in the first and second quarters, respectively. Chinese policymakers have set a growth target of roughly 6.5 percent for the year, down from 6.9 percent in 2017.

The slowdown could be from a combination of the trade war and deleveraging, said Betty Wang, China economist at ANZ. While China's exports to the US have held up and expanded this year as exporters rush goods across the Pacific to beat tariffs, the trade war has undermined confidence in the economy, Wang said. "The sentiment has definitely hit the market already," Wang said.

The key Shanghai Composite Index has fallen 22 percent this year amid the turbulence, while the yuan has fallen about nine percent against the dollar. Beijing faces a delicate balancing act as it tries to increase lending to private companies in need of credit, without further inflating the debt balloon.

The People's Bank of China has cut the amount of capital banks must hold in reserve several times this year, while the central bank's chief, Yi Gang, indicated this week there are more levers to pull to keep the economic growth rate up. Fixed-asset investment, especially in infrastructure, has fallen to record lows this year as Beijing pushed deleveraging and local governments idled or cancelled projects.

That has hit economic growth, analysts said, noting a rethink is underway. "We believe the authorities have already given priority to boosting the domestic economy over the stability of the RMB (yuan) policy and financial deleveraging," said Liu Ligang, Citibank's chief economist for China. Proactive policy responses could help stabilise growth at around 6.5 percent in the fourth quarter, Liu said. "The trade war may get worse before it gets better, and the impact on China's economy could be more material in the coming quarters," said Liu.

Relations between the world's two largest economies have soured sharply this year, as US President Donald Trump sought to inflict economic pain on China to force concessions in trade negotiations. Washington has hit roughly half of Chinese imports while Beijing has fired at most US imports. Exports still drive a significant chunk of China's economy and Washington's tariffs targeting cars, machinery, electronics, consumer appliances and others have led many firms to shift production and hold off on further China investment.

Economists expect the trade frictions to more heavily weigh on growth next year. The International Monetary Fund said this week that the window of opportunity for safeguarding global growth was "narrowing" as trade disputes deepen. The fund recently lowered its 2019 growth forecast for China, citing the trade war, forecasting its slowest expansion since 1990. The IMF also lowered estimates for the United States and the global economy as a whole.

BR100

15,115

Increased By

28.1 (0.19%)

BR30

43,048

Increased By

175.6 (0.41%)

KSE100

149,493

Increased By

257.8 (0.17%)

KSE30

45,518

Increased By

11.6 (0.03%)

Comments

Comments are closed.