Siemens Pakistan Engineering Company Limited (PSX: SIEM) dates its history from the pre-partition era. Its first office was set up in Lahore in 1922. Post partition, it was incorporated as a public limited company in 1963.

Siemens in Pakistan started off with a cable laying project in Karachi. The year it was incorporated it established a factory for motors, transformers and switch boards. Later in 1976, it introduced diesel generating sets.

Over the years it has extended its offerings. Today the company has multiple business divisions. These include power and gas (PG); power generation services (PS), energy management (EM), digital factory (DF), process industries and drives (PD) and LAS.

PG and PS divisions deal with supply, installation, commissioning, and services for power plants and related equipment. EM Division deals with execution of various projects under contracts including for substations and transmission, manufacturing and supply of low and medium voltage switchboards and panels, automation systems, transmission, and distribution equipment and related services.

DF and PD divisions deal with automation, information technology services and supply and installation of motors and drives while LAS deals with logistic and airport solutions and services.

Shareholding pattern The company's majority stockholdings are in the hands of Siemens AG, Germany that hold 75 percent of the shares. The other major shareholder is National Investment Trust.

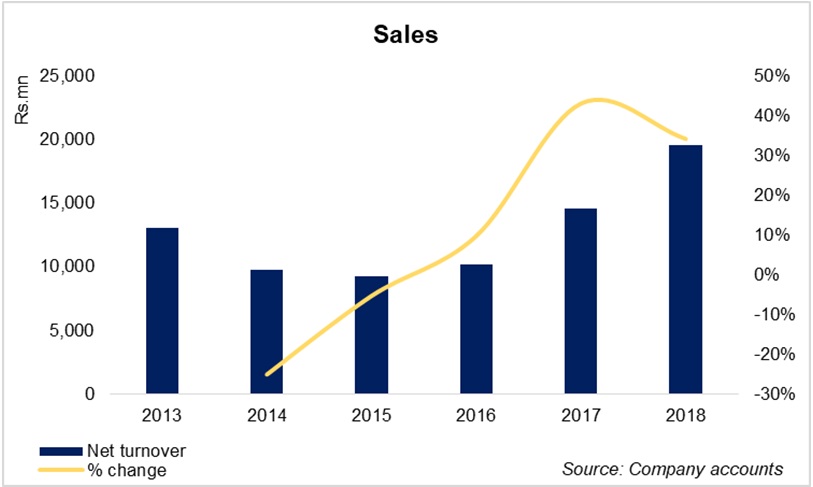

Financial history 2013 witnessed a loss due to termination of a contract worth nearly Rs2 billion by the Civil Aviation Authority relating to power supply and telecommunication network at the new Islamabad Airport.

While this impacted 2013's numbers, the company got the contract again in FY14. This didn't prevent the company from continuing to operate in losses with sales revenue down 25 percent from FY13. While the energy segments of the business continued to see new business, turnover declined due to missing orders from transformers and transmission business.

The highlight of 2015 was the signing of a contract with K-Electric worth about Rs10.7 billion for execution of transmission package. The purpose of the package was to enhance KE's transmission system capacity and improve reliability of its infrastructure. However, this did not prevent a drop in the top line and continuation of operating in losses. The losses were because of costs in the Islamabad Airport project, as well as other projects, while sales and new orders decreased. The reduced turnover was not able to absorb high fixed costs.

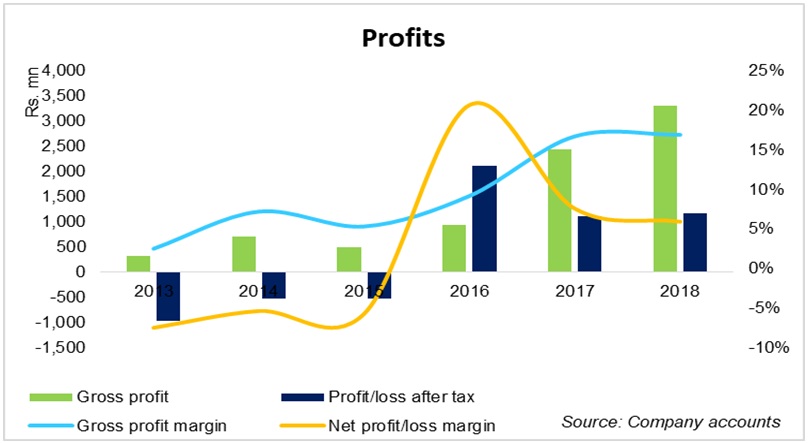

After a few years of restructuring and portfolio rationalisation, the company's losses took a turn for profits along with a 10 percent increase in the top line in FY16. In 2016, Siemens recorded onetime gains net of tax of Rs2.2 billion for the sale of leasehold/allotment rights of land and buildings in SITE, Karachi. Part of the proceeds also stemmed from the sale of distribution transformer manufacturing business, fixed assets pertaining to power transformer manufacturing facility, land and buildings in Islamabad, and healthcare business.

While sale of assets and business division supported the bottom line, resulting in the gross profit being higher than profit after tax, the top line was led from the EM division which contributed 74 percent of the total revenue of the company. Overall EM division revenue and operating profit increased by 23 percent and 122 percent respectively.

FY17 saw a continuation of positive trends since the top line jumped by 43 percent. Net profit declined YoY since the increase in FY16 was one off.

FY18 Performance Sales increased by 34 percent year-on-year due to execution of high value energy transmission projects in Pakistan and Afghanistan for the year ended in September 2018. These included a long term service contract with Punjab Thermal Power (Pvt) Limited, which was valued at about Rs8.4 billion for services provided for six years.

Healthy margins in the project, progress on Islamabad airport and gain on fair valuation of embedded derivatives led to a 54 percent increase in profit before tax. Fair valuation of embedded derivatives led to a gain of Rs239 million. Higher effective tax rate dragged down net profit which recorded an increase of 5 percent.

Future outlook Due to the global reorganisation of the board, the business portfolio will be changed from April 2019. Instead of the current business divisions the company will be operating in gas & power (G&P), smart infrastructure (SI), and digital industries (DI).

G&P will consist of business units of power generation, oil & gas, transmission, EPC projects, and services and digital. SI's units will operate in areas of factory automation, motion control, process automation and software and customer services.

Change in business divisions prior to FY16 led to an increase in revenue and profits. Further restructuring may yield benefits in the long run though adversely impact financials in the short run.

==========================================================

Siemens (Pakistan) Engineering Co. Limited

==========================================================

FY18 FY17 YoY

==========================================================

Net sales and services 19,522 14,553 34%

Cost of sales and services -16,220 -12,119 34%

Gross profit 3,302 2,434 36%

Marketing and selling expenses -754 -815 -7%

General administrative expenses -222 -210 6%

Other income 117 16 631%

Other operating expenses -166 -110 51%

Operating profit 2,276 1,316 73%

Net finance (expense)/income -43 136 -132%

Profit before tax 2,234 1,452 54%

Tax -1,074 -349 208%

Net profit 1,159 1,103 5%

EPS 140.56 133.79 5%

Gross margin 17% 17% 1%

Net margin 6% 8% -22%

==========================================================

Source: company accounts

=================================================================== Pattern of shareholding (as at September 30, 2018) =================================================================== Category Shares held % =================================================================== Directors 500 0.01 Associated companies, undertaking related party 6,156,782 75 NIP and ICP 1,042,683 13 Banks, insurance, modarabas and mutual funds 341,050 4 Pakistan National Shipping Corporation 6,930 0.08 General public 437,019 5 Others 262,073 3 Shareholders holding 5% or more Siemens AG, Germany 6,156,782 75 National Investment Trust 1,042,683 13 ===================================================================

Source: company accounts

Comments

Comments are closed.