Security Papers Limited (PSX: SPL) is a manufacturer of banknote paper and other security papers including prize bonds, saving certificates, non-judicial stamp paper, certificate paper for educational boards and degree paper for universities. SPL was established in 1965 as a private company and became a joint venture company of Iran, Turkey and Pakistan in 1967, under the protocol of RCD - now the Economic Coordination Organisation (ECO) in 1967.

As production of banknote paper is a sensitive matter, SPL employs high technological and quality related features including water marks, security thread, visible and invisible fluorescent fibers and fluorescent highlights. The company also produces paper for passports and cheques for which sensitised paper is designed to prevent fraud. SPL also manufactures educational degree certificates that incorporate watermarks, security thread and other anti-counterfeit measures. Other security papers manufactures by the company include judicial and non-judicial stamp paper, paper for identity cards, birth certificates and driving licenses and bond paper.

Shareholding pattern and stock price

As SPL is a joint venture between Pakistan, Turkey and Iran, 60 percent of the shareholding is divided amongst associated companies and related parties. Pakistan Security Printing Corporation (Pvt) Ltd., for which SPL is a major supplier, owns 40 percent while Sumer Holding A.S, a Turkish investment holding company owns 10 percent. The Industrial Development and Renovation Organisation of Iran also have a 10 percent stake. State Life Insurance Corporation of Pakistan also has an 8.5 percent stake. The general public only owns 9.7 percent of the stock so the majority is held by institutional investors and associated companies. SPL's stock price remained in tandem with the benchmark KSE-100 index till Aug-18 after which the company has continued to underperform KSE-100.

Historical performance

There is a growing demand for bank note and other security paper in the country, which is reflected in SPL's growing top line and lucrative margins over the past several years. In FY18 the company sold the highest ever quantity of banknote paper to its major client, the Pakistan Security Printing Corporation (Pvt.) Ltd. which resulted in the top line growing by 22 percent on a yearly basis. The top line growth came about due to higher sales volume, better prices as well as an improved product mix.

Specifically, the top line was helped mainly by the sales of banknote paper, which grew by almost 20 percent. Other security papers that include prize bonds, passport paper and educational degree also increased by an impressive 34 percent.

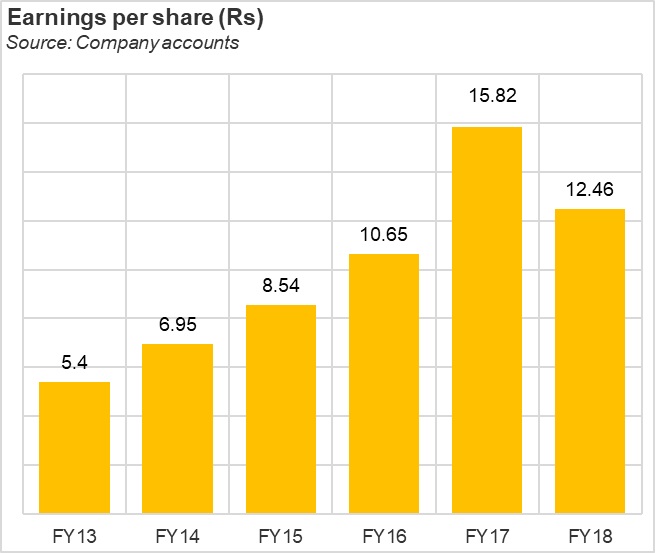

SPL's other income decreased as the company has invested in top rated mutual funds but the performance of the equity market in Pakistan has remained dismal during the past two years. The bearish market meant the company could not receive any capital gains and dividend income from its equity investments. As the support from other income was not there in FY18 the company's bottom line took a hit of 21 percent.

SPL has incurred sizeable capex outlay to tap the growing demand for security paper by expanding production capability. The company has enhanced pulping capacity by installing a set of beater and breaker assemblies and stainless steel chests. It has also invested in up-gradation by replacing the multi motor devices. For FY18 the company produced 3273 tons of bank note and other security paper as compared to 2822 tons in FY17 marking an increase of 16 percent.

SPL has been facing rising costs of raw material and production overheads due to both inflationary pressures and the rupee depreciation. However, the company notes in its annual report that it is intent on focusing on cost reduction measures to keep the pressure off its margins.

1QFY19 Snapshot

SPL produced 936 tons of paper during the quarter registering an increase of 28 percent on a year-on-year basis. The company's top line increased by 28 percent and the decent increase in the top line increased the gross profit by 54 percent. Demand for the company's products has witnessed a surge in recent years in both the banknote and other security papers segments. SPL's bottom line surged by 577 percent as a result.

Future outlook

SPL is going to set up water recycling plant, gas generator and reverse osmosis plant for efficiency gains as well as to ensure a reliable supply of its products. The company has also been focusing on increasing product diversification with the addition of cheque paper, passport paper and child registration certificate paper to increase profitability and enter new segments. It should be noted that as the population rises demand for both banknote as well as paper for educational certificates as well as prize bonds and child registration certificates will only increase in the years to come.

As SPL is uniquely poised to capitalise on the increased demand due to the niche market it operates in, the company's profitability looks set to increase in the coming years. The company has also increased production capacity to be able to keep up with rising demand.

In addition, whenever Pakistan's equity market becomes bullish, the company will realise gains on its equity portfolio which will give further boosts to profits.

============================================================== Pattern of shareholding ============================================================== Categories of shareholders % ============================================================== Associated Companies, undertakings and related parties 60 of which Sumer Holding A.S 10 Industrial Development and Renovation Organisation of I 10 Pakistan Security Printing Corporation (Pvt.) Ltd 40.03 Public sector companies and corporations 10.55 of which State Life Insurance Corporation of Pakistan 8.48 Pakistan Reinsurance Company Limited 1.57 EOBI 0.51 Banks, DFIs, NBFCs, Insurance companies, & Modaraba 11.62 Mutual funds 4.37 General public 9.7 Others 3.73 ==============================================================

Source: Company accounts

Comments

Comments are closed.