Six months ago, the macroeconomic situation was worse but the sentiments were not that negative, and today with external imbalances are of lesser magnitude, but the sentiments are down. There is something missing in managing the markets, businesses and people perception. The economic teams of PTI and SBP seem to lack ability to be ahead of the curve in terms of managing expectations.

The homework is missing and proactive engagement to manage expectations is the need of the hour. Not only the government lacks skill to communicate the exact economic situation to build narrative of why monetary tightening and currency adjustment was imperative; but also the politicians, media and capital market players are fueling the fire. This could be a naturally created panic or a concentrated effort by a few to make the incumbents look like a complete failure or a combination of both.

The news reporting by a few financial journalists is biased as they pick the lines from key government officials and quote them out of context. A few stock market players are pushing others to sell as they could be short themselves or they fear that this government has no plans to bail out the stock market which is to benefit a handful of investors, not the economy at large.

The businesses operating in informal segment are not happy as they may fear that they may get into the tax net eventually as they have been kept on enjoying healthy income without paying due share of taxes for ages. The salaried individuals are unhappy as unbelievable and unsustainable gift of lower tax rates given to them by Miftah Ismail of PML-N last year will likely be reversed.

The energy prices revision is due for years, PMLN pundits who are fueling the fire, knowingly the subsidies were unsustainable, but did not take the hit in their term. Miftah was chairman of SSGC, what did he do in his tenure to lower the losses. The government kept on approving new power plants on guaranteed returns but neither Miftah nor Abbasi stood against it. The only person at that time came in between PMLN top management and excessive power plants was the then Federal Secretary, Younus Dhaga, who was moved from the ministry on resistance.

The crackdown on Benami account is critical as it is linked to the compliance of FATF as well as it is imperative for broadening the tax base. But, this will snatch the abnormal profits from rent seekers. They are reacting to protect their self interest at the cost of economy at large. If the FBR raids a tax evader, the business community says that they are being harassed. When someone asks them why don't you pay taxes, they say that the margins are thin. How are the margins linked to income tax? They live a lavish life style, but pay peanuts in taxes.

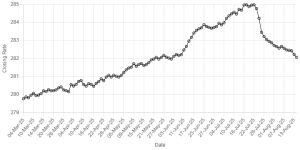

On top, the currency adjustment and interest rate hike are hurting public sentiment. Everyone knew that an overvalued currency in the Dar days was not sustainable and would hurt economy in the long run. But, now when actual adjustments are taking place, short-term pains are driving sentiments. It is a perfect time for making people confused. The economic emotions are weak due to eroding wealth effect and lowering income. Opposition is hitting the hammer hard, and making people believe that current economic mess, which in essence is a short time blip and is not happening for the first time in Pakistan, is purely due to mismanagement of PTI economic team.

Ishaq Dar is appearing on TV shows with top anchors asking him for advice while PMLN in Punjab wants him to be reinstated as finance minister. Why do they want Dar to be heard? Because it is hard to take pain and many want currency to appreciate back. Even they know that overvaluation in past was a big problem. The economic delusion is being tried to create.

The result of all this is hoarding of foreign currency and delay in investment plans. The government knew that people will cry hoarse when adjustments take place and reforms are being instilled. What is required by Asad and team, and SBP is to build the narrative of reforms. But before doing so, they have to have clarity in thoughts. They are taking too many U-turns which is supporting the narrative that they are weak and confused. They have to pick a side and stick to it. They should deliberate before making decisions, not to think after they decide.

For instance, why was 10 percent FED imposed on 1700cc cars when it has to be abolished? Why talk against amnesty scheme, when it has to be offered to bring benami in the system? Why build inflationary expectations, when actually the inflation is to be less relative to currency adjustment? Why talk about balance of payment woes today, when the current account is already down?

The fault lies on both ends. The reality is that the economic fundamentals are better today than they were when the government took office. The balance of payment crisis is largely averted. There have been induction of right people at various boards, and reform process may start soon. The government has to be proactive and street smart to handle the smart(er) people working for maintaining status quo.

BR100

15,003

Increased By

41.1 (0.27%)

BR30

42,253

Increased By

174.3 (0.41%)

KSE100

147,065

Increased By

573.1 (0.39%)

KSE30

44,884

Increased By

51.2 (0.11%)

Comments

Comments are closed.