Cherat Cement (PSX: CHCC) has been in the business of cement manufacturing since the 1980s like many of its current peers. It has remained one of the smaller cement firms until very recently when new expansion brought its capacity at par with some of the mid-tier players. In the third quarter of FY19, the company has commissioned its third line bringing its total capacity to 4.5 million tons. Cherat started with a production capacity of 1100 tons per day (more than 300,000 annually), and doubled it by 1994 after series of expansions. Cherat supplies cement to the markets in the north particularly KP, Punjab and Azad Kashmir while exporting to Afghanistan.

In 2002, Cherat merged with Cherat Electric after which it continued to raise capacity to 3300 tons per day (990,000 tons annually). It commissioned a second production line in 2014 which went online in Dec- 2017. Its third production line, as mentioned earlier, has the capacity of more than 6700 tons per day (over 2 million tons per 300 working days) which comes with a Waste Heat Recovery (WHR) plant alongside, three new Wartsila Diesel 34 Dual- Fuel engines of about 9.7MW each. These can run on gas, diesel and furnace oil. The gas pipeline is being laid and the company has obtained approval for gas connections from Sui Northern Gas Pipelines Limited. The company is financing the expansion through long-term debt.

Over the years, the company has added tyre derived fuel processing plant and refuses derived fuel processing plant along with WHR and diesel power plants to the mix for energy self-sufficiency and cutting power costs down. At the present, power costs are about 60 percent of the total costs of production for Cherat and in the same range or above for other cement manufacturers.

Shareholdings

As part of the Ghulam Faruque Group (GFG), Cherat's shares are primarily held by its Holding company Faruque (Private) limited. As on June 2018, nearly 22 percent of the shares were held by that company while other associate companies together held 7.26 percent of the company's shares including Cherat Packaging, Mirpurkhas Sugar mills and Greaves Pakistan. The Directors and family held a little over 5 percent shares. The general public held nearly 21 percent of Cheat's shares. The Ghulam Faruque Group has a range of businesses part of group that deal in manufacture and supply of cement, sugar, energy & power, appliances as well as packaging.

Cherat's operational and financial performance

Despite being a smaller manufacturer, Cherat cement has seen consistent growth over the years in terms of revenue, with its plants optimizing capacity in the past decade or so. Though until 2010, it was incurring losses, the company turned it around and in just two years, had improved its gross margins to 35 percent (FY10: 3%). Since the industry depends primarily on domestic demand, local demand dynamics play a pivotal role in earnings growth. However, the industry is also an exporter of cement and clinker which helps it diversify its supply mix to a great extent, if need be.

At peak demand during FY16-FY18, Cherat saw its revenues double in just two years. Part of the reason is that it brought a new expansion during FY18 which help ramp up production and grab a higher market share, consequently a bigger top line. However, costs of imports play a driving role in where margins land. Despite that aforementioned bigger top line during FY18, Cherat saw its margins dramatically drop to 22 percent during the year, against 33 percent during FY17 (FY16: 37%). According to the annual report, imported material is 70 percent of the total raw material that is used at the Cherat factories. Meanwhile, the imported material and local raw material are 37.5 percent and 16.7 percent of the cost of sales respectively. As calculated by the company, the cost of sales of the company moves up or down by 3.75 percent and 7.51 percent in case of foreign currency fluctuation of 10 percent and 20 percent respectively.

Since such a large portion of raw material is imported, exchange risk for the company is high. Evidently, the loss in margins during FY18 and the subsequent fall during the ongoing FY19 is caused by the depreciating rupee. International prices for coal which is an important fuel import also impact the costs of production significantly.

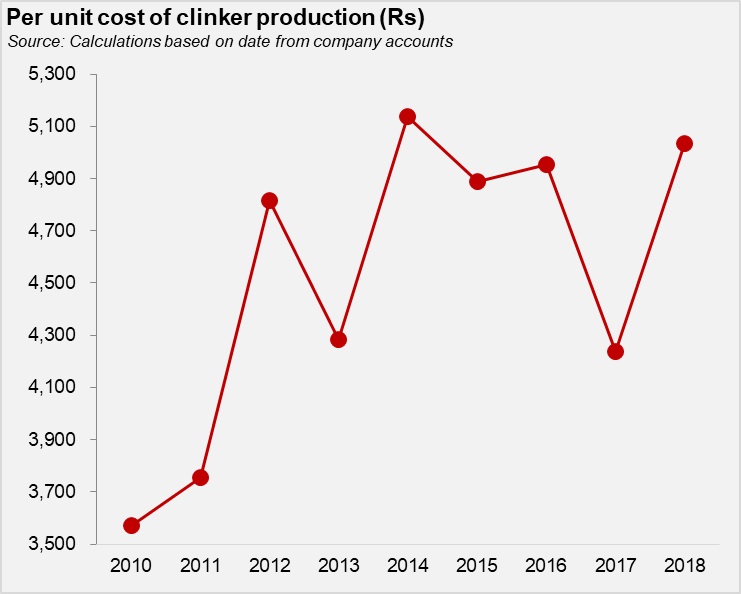

The other factor of course is retention prices for cement. Prices start to fall when competition grows and demand wanes. Cherat's expansion in Dec-17 led to a sudden drop in prices as overall industry capacity grew without a great improvement in domestic demand. Prices started to improve thereafter, but overall the cost-price dynamics ultimately resulted in the shortfall in margins as witnessed. Revenue per ton as calculated fell as per unit cost of clinker production rose during FY18 (see graph).

According to the annual report, the company believes it shielded margins from falling too much by controlling power costs and using the right mix of WHR, national grid and own generation. That may be true because the real bleeding is happening now during FY19 and only lower effective tax are shielding cement manufacturers from landing in single-digit net profit margins.

Latest financials and outlook

First of all, demand is not on cement industry's side. Domestic demand has been falling due to the change in government and new measures being taken to slow down the economy including PSDP cuts. Construction in the private sector has not been as robust either. This is why as local domestic dispatches fall; companies are now selling more abroad. According to Cherat's quarterly report, during 9MFY19, local cement sales declined by 11 percent and exports to Afghanistan dropped by 13 percent compared to the corresponding period last year. Indeed, while cement makers in the south have the advantage of selling of their cement to markets overseas, those in the north incur too much transportation cost to sell to those markets. They have to rely on bordered markets-of which both Afghanistan and India have become lethargic. Indian market in fact, has all but shut down due to political tensions.

That takes care of the slowdown in revenue. Retention prices particularly in the north have been shaky. Between Feb and March, prices dropped by Rs20 per cement bag or more (read more: "cement cartel: do not resuscitate", April 11, 2019). On average, prices remained on the same level as the previous year but could not grow to register a better revenue growth.

The other problem which has only exacerbated is the cost of imports. Coal imports for cement manufacturers have become ever more expensive due to an average increase in its own international prices, and the latest round of rupee depreciations. The rupee depreciated by 13 percent between July-18 and Mar-19 and by 27 percent since Jan-18. The 13 percent depreciation led to a 4 percent decrease in cost of sales is in line with Cherat's earlier estimations. Meanwhile, coal prices averaged $4 per ton higher during 9MFY19, against the period last year, though prices slid down during some of the months.

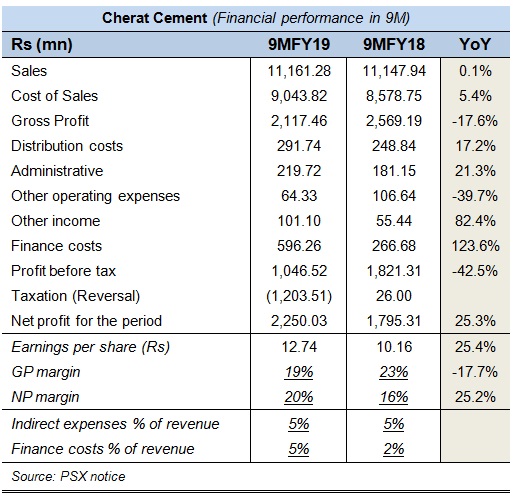

Cherat seems to have managed its inventories well but lazy domestic demand, lack of options in terms of markets, together with less than ideal prices and costs led to a fall in margin to 19 percent during the period. Though its indirect expenses remained 5 percent constant of revenues, its finance costs grew to 5 percent, from 2 percent as a share of net revenues. Expansion related borrowing and higher financing rates are ballooning these costs. Net profit margin however, grew to 20 percent from 16 percent last year due to a tax reversal the company received. As a comparison, before tax net margin fell to 9 percent.

The industry is going through a tough period, which will continue well into FY20 as the government tries to get out of the economic mess it is in. Even if domestic demand improves, rising industry capacities will lead to price competition, while inflation and currency adjustments will further put pressure on costs. Exports also cannot come to the rescue of manufacturers in the north.

Copyright Business Recorder, 2019

Comments

Comments are closed.