Pakistan Petroleum Limited (PSX: PPL) has been an aggressive player in the oil and gas exploration and production sector, responsible for over 22 percent of the country's gas production. In 1997, BOC disinvested from the E&P sector worldwide and sold its equity in PPL to the Government of Pakistan. Later, the GoP holding was reduced via an IPO in 2004 and was further decreased with the initiation of the Benazir Employees Stock Option Scheme (BESOS) in 2009 followed by a further divestment of another 5 percent shares in a secondary public offering in 2014. The company's majority shareholding rest with the government, owning 67.5 percent shares. A breakup of both ordinary shares and convertible preference shares is shown in the illustration.

For its exploration acreage and portfolio, PPL and its subsidiaries hold 44 exploration blocks where 26 blocks are operated by PPL (including one in Iraq) and 18 are operated by the partners including three offshore blocks in Pakistan and an on-shore block in Yemen. One exploratory block in Yemen has been relinquished due to security issues in the region. PPL operates 10 producing fields that include Sui, Kandhkot, Adhi, Mazarani, Chachar, Adam, Adam West, Shahdadpur, Shahdadpur East and Shahdadpur West; and holds working interest in around 17 partner-operated producing fields that include Qadirpur, Miano, Sawan and the famous Tal Block.

PPL has three fully-owned subsidiaries: PPL Europe E&P Limited (PPLE), PPL Asia E&P B.V. (PPLA) and Pakistan Petroleum Provident Fund Trust Company (Private) Limited (PPPFTC). These are part of the Group. Except PPPFTC, the group is principally engaged in conducting exploration, prospecting, development and production of oil and natural gas resources.

Past performance

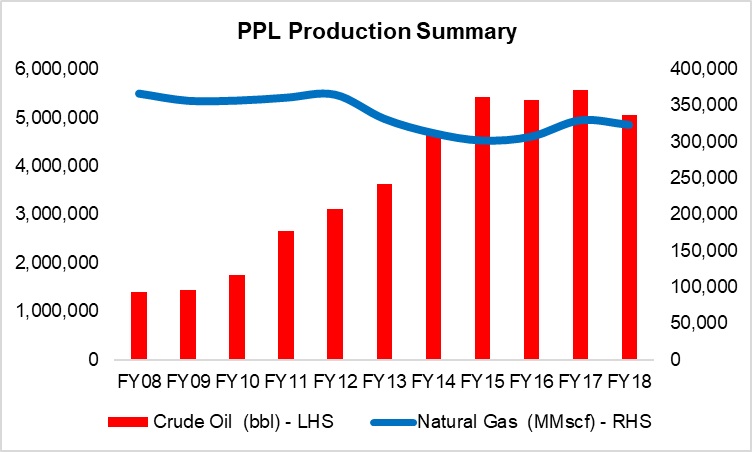

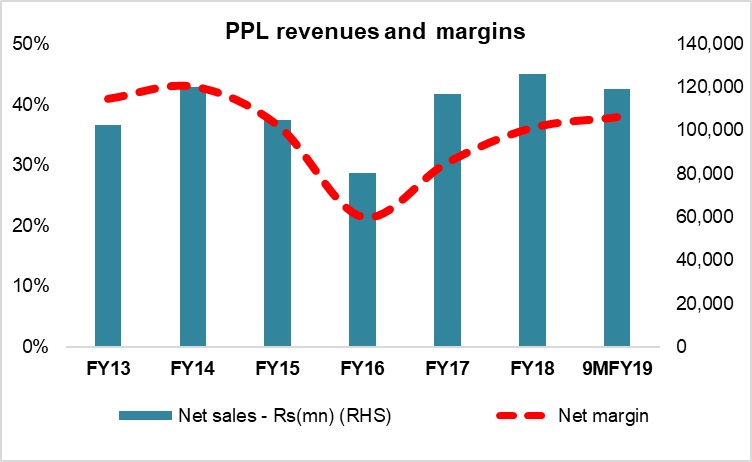

A look beyond FY13 shows that PPL that has been aggressively towards hydrocarbon drilling, continued to see growth in profits. However, the company's overall gas production dwindled due to depleting gas reserves in the country and the decline largely came from the firm's pioneering but maturing fields like Sui, Miano, Kandhot and Sawan. On the other hand, higher crude oil production and prices along with higher gas wellhead prices compensated to lower gas volumes resulting in higher revenues and earnings for PPL. However, in FY15, earnings took a hit due to lower oil prices, which continued in FY16.

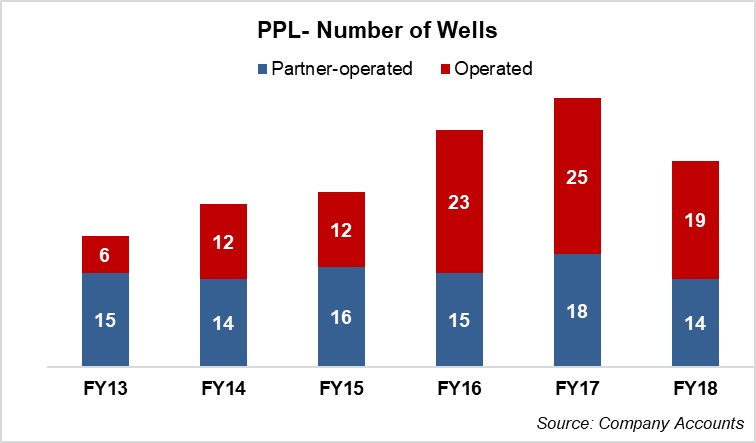

FY17 was marked by a recovery in oil prices, a much needed breather for the E&P sector. PPL did well in FY17; the company's performance was highlighted by a whopping increase in its earnings largely led by revenue growth, which was around 46 percent year-on-year, while the earnings more than doubled. The same year, the firm also received gas price adjustment of Rs 31.12 billion for 25 months starting June 2015 to June 2017, which lifted the top line along with improvement in natural gas output from its key fields: Sui and Kandot. PPL's overall production exceeded the firm's long time average of 1 bcfd, registering a growth of around 8 percent year-on-year. earnings were also pushed up by lower finance costs and Exploration costs - despite the company's aggressive drilling activity. During FY17, PPL drilled 28 development wells, out of which 15 were drilled in areas operated exclusively by the company, while 13 wells were drilled in areas operated by the company's partners.

FY18 was another positive year for the E&P sector as oil prices continued to trot up. The same year, PPL earned the second highest profit in its history. Its drilling activity included 11 exploration wells in operated areas including 3 wells in frontier areas, whereas 7 exploration wells were drilled in partner-operated areas. The firm also made a discovery PPL-operated area. The company also drilled 15 development wells, which include 8 in operated areas and 7 development wells in partner-operated areas. The annual report highlights that the firm was able to arrest the decline in maturing fields through a year-on-year production increase from Gambat South, Adhi, Tal and Kirthar fields.

Overall, PPL's gas and oil production declined slightly in FY18. Despite a decline in volumes, higher oil prices and rupee depreciation resulted in 8 percent year-on-year increase in revenues for PPL in that year; while the PAT increased by 28 percent, year-on-year, led by revenue growth, rise in other income and decline in other charges and levies. This was partially offset by increase in operating expenditures. The increase in other income came from exchange gain, receipt of signature bonus from UEPL against farm out of Kotri North block, and receipt of late payment surcharge from Asia Resources Oil Limited. On the other hand, the decline other charges were due to recording of impairment loss on investment in wholly owned subsidiary, PPL Asia E&P B.V (PPLA) in FY17.

PPL in 9MFY19 and beyond

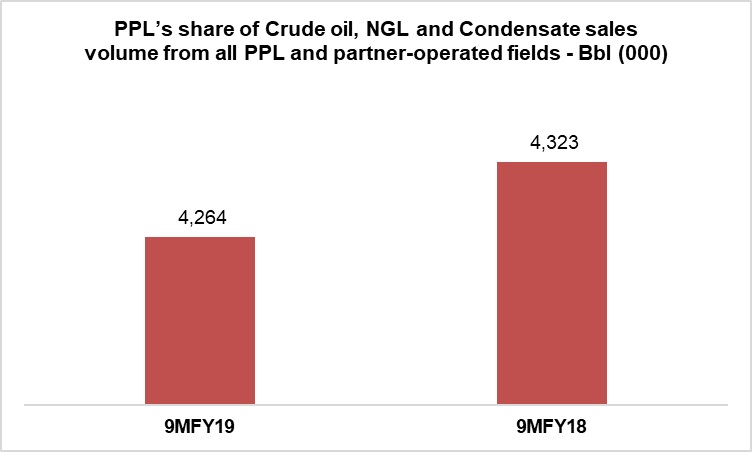

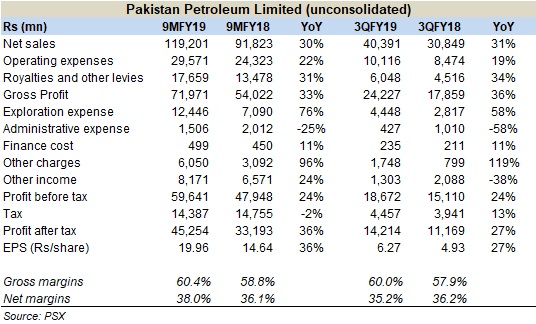

The company has remained robust in 9MFY19 so far where earnings increased by 36 percent year-on-year, driven by higher crude oil prices and currency depreciation The firm's revenues for 9MFY19 saw a growth of 30 percent year-on-year, which came from higher international crude oil prices by 18 percent year-on-year along with currency depreciation of about 23 percent. On the other hand, volumetric growth dropped slightly during the period. Crude oil sales volume decline by one percent, while gas volumes slipped by two percent year-on-year in 9MFY19.

The firm's margins increased and beside the growth in sales revenues, reversal of impairment loss on investment in PPLE and higher exchange gains lifted margins. On the other hand, higher operating costs, royalties and higher exploration and prospecting expenditure offset the growth rate in earnings.

The company witnessed a 76 percent year-on-year growth in exploration and prospecting expenditure in 9MFY19 that came from high cost of dry wells charged in the current period, and also from the recovery of past cost from United Energy Limited against farm out of the company's 50 percent working interest in Kotri North Block along with transfer of operatorship, Overall, PPL's net profit after tax stood 36 percent year-on-year higher in 9MFY19.

During the latest nine-month period, PPL made the highest number of discoveries in the E&P sector: 6 in PPL-operated blocks and 2 in partner-operated blocks. In addition to that, one discovery was made in PPL Europe (formerly known as MND Exploration & Production) as well in a partner-operated block in Balochistan. Five wells were spudded during the period that included 4 exploratory and 1 development well. One issue that the company highlights in its quarterly accounts is the continued stress on its liquidity due to muted recovery in receivables. These increased by a staggering 45 percent and stood at 207 billion on March 31, 2019 versus Dec 31, 2018.

Comments

Comments are closed.