Amreli Steels Limited (PSX: ASTL) is a major long steel manufacturer in Pakistan operating in the country for over 50 years. The company has gone from manufacturing hardware items (nails, screws and wire rods) to ship breaking to setting up hot rolling mills to produce steel bars and the intermediate product billets. The management imported a semi-automatic mill from the UK and converted Amreliwala Hardware Industries into a private limited company.

By 1993, the company was manufacturing 50,000 tons of steel bars, expanding to 75,000 and later 180,000 tons per annum. In 2008, Amreli also introduced Thermo Mechanical Treatment technology in Pakistan for the production of high strength deformed bars. Later, earthquake resistant rebars were introduced. The company's plant has the capacity to make 30 tons of straight bars each hour. Amreli also started producing billets in-house and reduce dependence on imported or domestic billets manufactured at Pakistan Steel Mills (PSM). Since the public sector enterprise' shut down, this move may have helped. The billets capacity production was 200,000 tons but has been doubled in the latest round of expansion undertaken by the government. Its steel rolling capacity has so far been expanded to 600,000 and is expected to take up to 750,000 by FY20.

The company is a family owned businesses which started off small and grew to the size it is now. Despite going public, over 70 percent holdings are kept within the family. About 16 percent of the shares are with financial and insurance institutions including banks, DFIs and mutual funds.

Financial and operational performance

Amreli is undoubtedly a leading player in long steel products and even before the expansion had the largest manufacturing facilities. Though capacity utilisation for the company has remained above 80 percent, the company's performance follows the performance of the economy and whether it is expanding or contracting since long products are primarily used in infrastructure, construction and real estate development projects. When government spending grows, steel performance also grows.

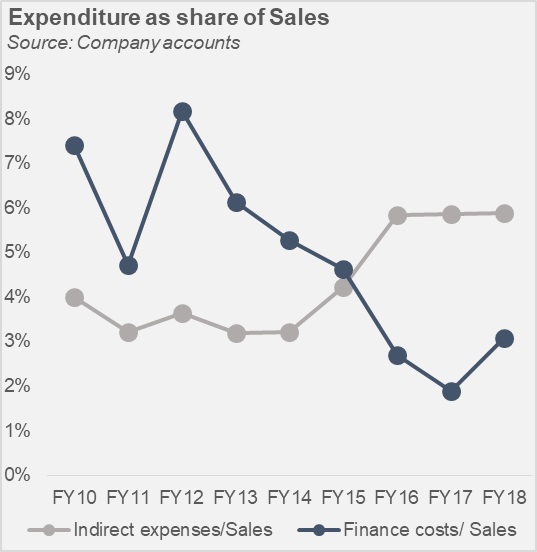

Billet production utilisation post expansion is 53 percent in FY18 against 82 percent last year and its 73 percent for bars against 88 percent last year. The lower utilisation primarily due to the expansion that came about during FY18. Amreli has grown from a Rs 4 billion company to Rs 15 billion over the past eight years with moderate growth in sales and end user prices. Amreli was buying billets from PSM and later on importing but after starting production of this raw material, Amreli's costs have been lowered helping margins to improve since FY11 reaching 23 percent during FY16. Margins fell during FY17 and FY18 due to higher prices for steel scrap, which is also imported, coupled with currency fluctuations and the recent rupee devaluation that has also impacted margins.

During FY18, high advertisements caused distribution costs to rise while finance costs rose due to higher term finance cost and upward revision in interest rates and increased working capital needs. The company also paid a much higher gas infrastructure development cess (GIDC), which raised the per ton cost of production across the board. Despite that, the company raised revenues as well as the bottom line during FY18.

Recent financials and outlook

Steel is central to the brick and mortar of a developing economy and can take more than15 percent of the total cost of building. Though the economy has stepped into an austerity drive, PSDP spending and CPEC projects are still on track. Infrastructure projects may continue to provide demand for long steel producers like Amreli.

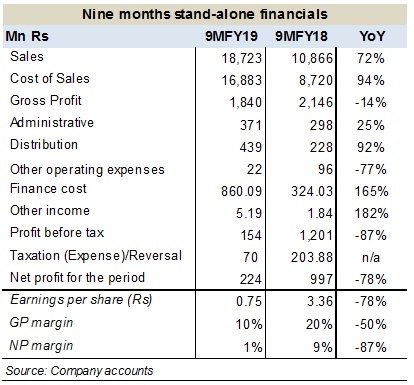

In 9MFY19, the company has managed to grow revenues by 72 percent as the higher capacity is being absorbed now. However, higher distribution and administrative expenditure due to advertisement expenditures while higher finance costs due to the rising cost of borrowing caused profits to decline.

In the budget 2020 the government has announced a new tariff regime for steel which would cause steel prices to increase and may pose a challenge for the construction industry in terms of cost. However, if the promised 5 million house construction starts to take shape soon, Amreli and its peers will see demand move upwards despite the slowdown in the economy, something that Amreli is prepared for capacity wise. On the imports front also, there is some good news. There is an antidumping duty placed for long steel import from China and Ukraine. Meanwhile, regulatory duties are also in place.

On the cost side, monetary policy tightening may further put pressures on financial costs while, scrap prices globally and further rupee devaluation may cause costs of production to increase and margins decline.

BR100

11,988

Decreased By

-121.3 (-1%)

BR30

36,198

Decreased By

-400.2 (-1.09%)

KSE100

113,443

Decreased By

-1598.8 (-1.39%)

KSE30

35,635

Decreased By

-564.3 (-1.56%)

Comments

Comments are closed.