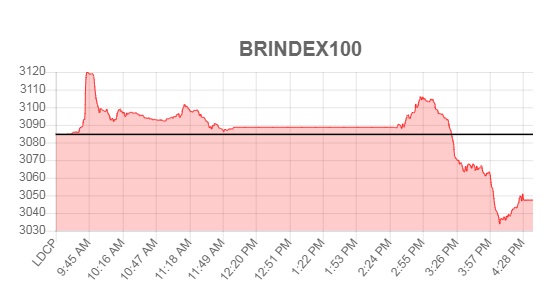

KSE-100 Index suffers further pruning; BRIndex100 stays bearish

Pakistan Stock Exchange Friday witnessed another bearish session as the investors remained on the selling side following concerns over geopolitical situation. BRIndex100 lost 39.68 points or 1.29 percent to close at 3,044.93 points. BRIndex100 touched intraday high of 3,119.85 and intraday low of 3,033.83 points. Volumes stood at 72.820 million shares.

BRIndex30 decreased by 254.41 points or 1.62 percent to close at 15,464.40 points with a turnover of 49.923 million shares.

The KSE-100 Index declined by 308.91 points or 1.04 percent to close at 29,429.07 points. Trading activity remained thin as daily volumes on the ready counter decreased to 76.410 million shares as compared to 109.097 million shares traded Thursday.

Foreign investors remained net sellers of shares worth $0.8 million. The market capitalization declined by Rs 29 billion to Rs 6.020 trillion. Out of total 321 active scrips, 170 closed in positive, 134 in negative while the value of 17 stocks remained unchanged.

Maple Leaf was the volume leader with 7.762 million shares. It gained Re 0.80 to close at Rs 18.04 followed by Engro Polymer that lost Rs 1.14 to close at Rs 21.73 with 5.067 million shares.

Nestle Pakistan and Abbott Lab were the top gainers with Rs 287.00 and Rs 8.52, respectively to close at Rs 6,300.00 and Rs 363.00.

Mari Petroleum and Khyber Textile were the top losers with Rs 19.87 and Rs 19.54, respectively to close at Rs 852.17 and Rs 371.43.

BR Automobile Assembler Index lost 27.47 points or 0.57 percent to close at 4,796.60 points with total turnover of 937,670 shares.

BR Cement Index fell by 13.15 points or 0.51 percent to close at 2,608.28 points with 14.815 million shares.

BR Commercial Banks Index declined by 119.11 points or 1.68 percent to close at 6,973.82 points with 9.571 million shares.

BR Power Generation and Distribution Index closed at 3,980.53 points, down 6.38 points or 0.16 percent with 3.939 million shares.

BR Oil and Gas Index decreased by 82.69 points or 2.46 percent to close at 3,276.70 points with 6.746 million shares.

BR Tech. & Comm. Index gained 5.85 points or 0.92 percent to close at 640.80 points with 9.857 million shares. An analyst at Arif Habib Limited said that the market continued trimming down, with selling pressure in Banks, E&P and Cement stocks. Coming MSCI review had Investors concern about selling activity from foreigners, which caused this selling pressure in blue chip stocks in Banks, E&P and Cement sectors. Mid cap Cement, Steel and Refinery sector scrips traded green. NCL hit upper circuit upon notification of buy back. Cement sector led the volumes table with 14.8 million shares, followed by Technology (9.8 million shares) and Banks (9.5 million shares).

Sectors contributing to the market performance include Banks (down 143 points), E&P (down 119 points), Fertilizer (down 49 points), O&GMCs (down 22 points) and Chemical (down 11 points).

Stocks that contributed positively include NESTLE (up 14 points), MCB (up 11 points), DGKC (up 10 points), KTML (up 5 points) and MLCF (up 5 points). Stocks that contributed negatively include HBL (down 75 points), OGDC (down 47 points), PPL (down 46 points), BAHL (down 30 points) and ENGRO (down 29 points).

Comments

Comments are closed.