KSE-100 index falls: BRIndex100 loses 5.75 point

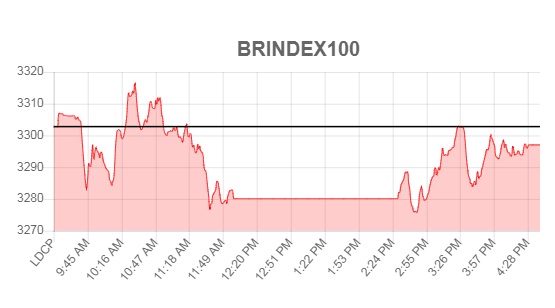

Pakistan Stock Exchange ended on negative note on the last day of the week as the investors opted to book profit on available margins in various sectors. BRIndex100 lost 5.75 points or 0.17 percent to close at 3,297.04 points on Friday. During the session, the BRIndex-100 touched an intraday high of 3,316.02 and an intraday low of 3,275.67 points. Total volumes stood at 95.621 million shares.

BRIndex30 decreased by 75.45 points or 0.44 percent to close at 17,105.56 points with total turnover of 69.842 million shares. KSE-100 index declined by 65.30 points or 0.21 percent and closed at 31,481.31 points. Trading activities remained low as daily volumes on ready counter decreased to 103.093 million shares as compared to 185.842 million shares traded on Thursday.

Total market capitalization declined by Rs 11 billion to Rs 6.312 trillion. Out of total 340 active scrips, 159 closed in positive and 153 in negative while the value of 28 stocks remained unchanged. Maple Leaf was the volume leader with 7.524 million shares however lost Rs 0.22 to close at Rs 16.65 followed by Unity Foods that gained Rs 0.16 to close at Rs 8.88 with 7.126 million shares. Lucky Cement and Pak Gum & Chem were the top gainers increasing by Rs 16.70 and Rs 11.62 respectively to close at Rs 373.40 and Rs 251.63 while Rafhan Maize and Mari Petroleum were the top losers declining by Rs 200.00 and Rs 32.23 respectively to close at Rs 6000.00 and Rs 841.35.

BR Automobile Assembler Index declined by 126.31 points or 2.57 percent to close at 4,782.36 points with total turnover of 1.216 million shares. BR Cement Index increased by 56.21 points or 2.05 percent to close at 2,797.18 points with 18.760 million shares. BR Commercial Banks Index decreased by 96.52 points or 1.26 percent to close at 7,535.90 points with 6.629 million shares.

BR Power Generation and Distribution Index lost 36.3 points or 0.81 percent to close at 4,435.19 points with 7.542 million shares. BR Oil and Gas Index inched up by 0.65 points or 0.02 percent to close at 3,475.96 points with 13.405 million shares. BR Tech. & Comm. Index closed at 649.92 points, down 2.16 points or 0.33 percent with 6.878 million shares.

An analyst at Arif Habib Limited said that the market traded in a narrow range between plus 83 points and minus 267 points. Mixed trend was witnessed in E&P scrips that brought the index in red zone. Cement and Steel sector scrips also made positive moves with ASTL and MUGHAL hitting upper circuits. Stocks that contributed to selling pressure mainly included HUBC, HBL and MLCF. Cement sector led the volumes table with 18.7 million shares followed by E&P (7.1 million shares) and Engineering (8.2 million shares).

Sectors contributing to the performance include Cement (up 43 points), Fertilizer (up 16 points), Insurance (up 11 points), Banks (down 116 points), Autos (down 23 points) and Power (down 23 points). Stocks that contributed positively include LUCK (up 47 points), EFERT (up 15 points), KAPCO (up 15 points), PPL (up 14 points) and UBL (up 10 points). Stocks that contributed negatively include HBL (down 69 points), HUBC (down 35 points), MCB (down 34 points), MARI (down 17 points) and BAHL (down 17 points).

Comments

Comments are closed.