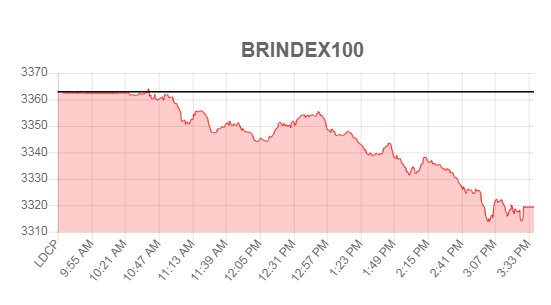

Selling pressure sets in on PSX: BRIndex100 takes a dip

Pakistan Stock Exchange Monday witnessed a bearish trend due to selling in various sectors on the beginning of the rollover week.

BRIndex100 lost 43.60 points or 1.30 percent to close at 3,319.29 points. BRIndex100 touched intraday high of 3,363.81 and intraday low of 3,314.10 points. Volumes stood at 78.029 million shares.

BRIndex30 decreased by 389.3 points or 2.21 percent to close at 17,187.42 points with a turnover of 50.993 million shares.

The KSE-100 Index declined by 359.89 points or 1.12 percent to close at 31,751.21 points. Trading activity remained low as daily volumes on the ready counter decreased to 86.617 million shares as compared to 153.277 million shares traded Friday.

The market capitalization declined by Rs 66 billion to Rs 6.331 trillion. Out of total 345 active scrips, 227 closed in negative, only 95 in positive while the value of 23 stocks remained unchanged.

Maple Leaf was the volume leader with 6.394 million shares. However, it declined by Re 1.00 to close at Rs 14.74 followed by PSO that lost Re 0.83 to close at Rs 152.67 with 5.230 million shares. Rafhan Maize and Gatron Industries were the top gainers with Rs 100.00 and Rs 22.00, respectively to close at Rs 5,800.00 and Rs 480.00. Colgate Palmolive and Bhanero Textile were the top losers with Rs 107.00 and Rs 40.56, respectively to close at Rs 2,037.00 and Rs 810.00.

BR Automobile Assembler Index lost 25.31 points or 0.52 percent to close at 4,811.27 points with a turnover of 1.030 million shares.

BR Cement Index decreased by 68.36 points or 2.56 percent to close at 2,600.45 points with 15.712 million shares.

BR Commercial Banks Index declined by 85.15 points or 1.11 percent to close at 7,569.05 points with 3.858 million shares.

BR Power Generation and Distribution Index fell by 24.52 points or 0.55 percent to close at 4,446.18 points with 4.509 million shares.

BR Oil and Gas Index plunged by 69.86 points or 1.91 percent to close at 3,579.56 points with 12.506 million shares.

BR Tech. & Comm. Index closed at 651.09 points, down 5.92 points or 0.9 percent with 9.490 million shares.

An analyst at Arif Habib Limited said that start of the rollover week saw market taking negative direction and an overall decline of 400 points during the session. Although international crude prices were at similar levels as observed at the end of last week, local oil and gas chain showed receding stock prices from E&P to OMCs. Resultantly, OGDC, PPL, ATRL, NRL, PSO showed significant declines.

Besides, cement and banking sector stocks also saw selling pressure. MLCF issued financial projections pertinent with 85 percent Rights issue that showed near term losses and caused the stock price to hit lower circuit. Cement sector led the volumes with 15.7 million shares, followed by Technology (9.5 million shares) and O&GMCs (8 million shares).

Sectors contributing to the performance include Banks (down 101 points), E&P (down 94 points), Cement (down 46 points), O&GMCs (down 26 points) and Pharma (down 21 points). Stocks that contributed positively include ENGRO (up 19 points), SHFA (up 5 points), BAHL (up 5 points), JLICL (up 5 points) and HGFA (up 4 points). Stocks that contributed negatively include OGDC (down 55 points), HBL (down 45 points), PPL (down 39 points), MCB (down 21 points) and UBL (down 20 points).

Comments

Comments are closed.