Hascol Petroleum Limited (PSX: HASCOL) was incorporated as a private limited company on March 28, 2001 and was converted into a public unlisted company in 2007, while in 2014 Hascol was listed on Pakistan Stock Exchange Limited. The firm was granted an Oil Marketing License by the Government of Pakistan in 2005 for the purchase, storage and sale of petroleum products like high speed diesel, gasoline, fuel oil and FUCHS lubricants.

In a very short time, Hascol Petroleum Limited has come a long way in the downstream oil and gas marketing sector. In just a decade it achieved the status of largest OMC after PSO in terms of storage. In November 2015, the global oil trader, Vitol acquired 15 percent of HASCOL and another 10 percent in 2016, which made Vitol Dubai Limited the largest shareholder in the company. The other prominent shareholders in the company include local firms like Fossil Energy (Pvt.) Limited and Marshal Gas (Pvt.) Limited; and Mumtaz Hasan Khan who is the Chairman and the Director of the company - as per the company's latest shareholding pattern available.

HASCOL has a strategic license agreement with FUCHS Middle East (FOMEL), an associate of FUCHS Petrolub based in Germany, to represent the brand in Pakistan. It also markets LPG through its retail network for the automotive sector, and currently there are 15 AutoMax LPG stations across Pakistan in various stages of approval with the government.

HASCOL and Vitol have also entered into a joint venture company for marketing of LNG in the country with 30/70 percent share, respectively. HASCOL has also signed a Technical Services Agreement with Vitol Aviation to enable the firm to start fuelling aircrafts at Karachi, Lahore and Islamabad airports in the country.

HASCOL in the recent past

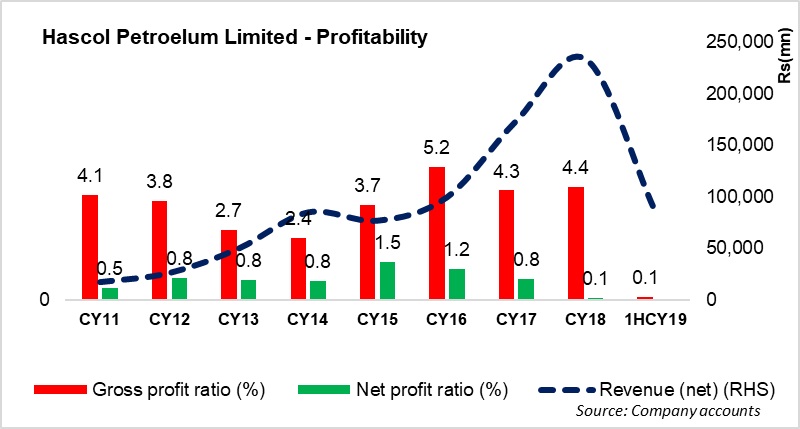

Hascol Petroleum Limited's performance as an oil marketing company has been on point as company capitalised the booming POL demand in the country that focused primarily on the retail side. At the same time, the company in collaboration with its international sponsor Vitol added 232,000 cubic metres of oil storage capacity at Port Qasim, taking its storage to 28 days from 16 days previously.

HASCOL also took a share of the growing demand of petroleum products in the country as it indulged in aggressive expansion in the storage facilities and volumetric sales. It overtook its competitors to become the second largest OMC in Pakistan in terms of volumes with a CAGR of 54 percent over 2011-16. As of March 31, 2019, the company had 571 retail outlets in Pakistan according to the company's website. The table shows the province-wise breakup where their concentration continues to be in Punjab and Sindh.

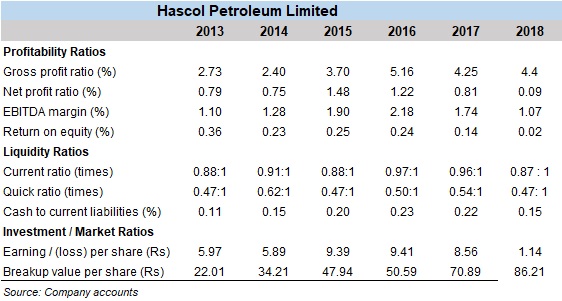

HASCOL's operational performance for FY16 was sanguine as the volumes increased by almost 46 percent with improved net margins during the year. Key highlights for 2016 included the commissioning of ZY terminal at Keamari that enabled the company to import larger volumes of motor gasoline; and the completion of a storage facility at Mehmood Kot that enabled the firm to receive diesel directly via pipeline from Karachi. The company also set up Hascol Terminals Limited with Vitol for 200,000 metric tons of storage at Port Qasim.

Expansion of its supply chain network continued in 2017. Increased volumetric sales of retail fuels continued where the company's share in white oil reached 12 percent in 2017 versus 2 percent four years ago. During the year, HASCOL also started a chemical business for importing bulk chemicals and supplying to end users. Its volumes increased by 39 percent year-on-year in CY17, with revenues growing by 75 percent, and gross profit growing by 44 percent, year-on-year. Earnings for the year increased by over 15 percent, year-on-year. The same year, HASCOL also announced right issue of 20 percent to fund upcoming projects like development of storage facilities, retail outlets and lube oil and grease blending plant.

While the company's revenues increased by 35 percent; the increase came from higher prices of retail fuels and not growth in volumes. This decline in volumes for the company came as a general downtrend in the consumption patterns in the country as well as increasing competition. Higher margins earned on retail fuels resulted in growth in gross profit by 39 percent, year-on-year in 2018. However, performance took an unwanted turn in 2018 as the oil and gas downstream sector was bitten by high exchange losses due to rapid currency depreciation. This can also be seen from the HASCOL's stock performance against the benchmark. HASCOL's profits fell by 85 percent, year-on-year primarily due to exchange losses and also due to increased borrowings for capex as well as working capital needs.

HASCOL in 2019 and beyond The company is hopeful to commission its lube blending plant in June this year, which will give a boost to its lube sales. It is also aggressively developing its storage infrastructure and retail network.

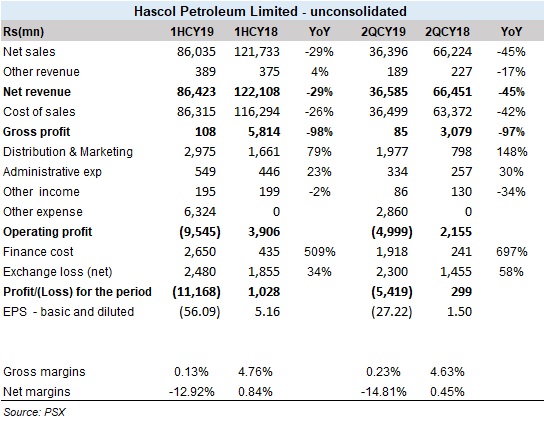

During the first half of 2019, exchange losses continued to overshadow any growth in revenues or reduction in other costs for HASCOL. This was in line with the oil marketing segment's performance that has been marred by exchange losses where smaller players have been hit harder than the big players.

After a glimpse of some recovery in 1QCY19, HASCOL's performance in 2QCY19 deteriorated, which painted an overall bleeding picture for 1HCY19. On a year-on-year basis, the OMC's revenues declined by 29 percent in 1HCY19. Volumes took a dive of about 60 percent year-on-year in the 2QCY19. Product wise, all key products registered a decline in the period under review. And it is also expected that the firm's kept its imports in check to lower the impact of currency depreciation.

HASCOL's net exchange losses for 1HCY19 were up by 34 percent, year-on-year. Also, the finance cost of the company witnessed over six times increase, which came from increase in bank borrowing and financing along with higher interest rate environment. What further dented the bottom-line was the other expense, which was at a staggering level of Rs6.32 billion in 1HCY19 against none in 1HCY18. While it is still not known what exactly was the major reason for such an enormous growth in other expenses, normally other expenses for HASCOL have entailed provisions for doubtful debts, franchise income etc. HASCOL ended up with a loss of Rs11 billion in 1HCY19 versus a profit of Rs1 billion in 1HCY18 as per its unconsolidated accounts.

According to the company's quarterly accounts, the Board of Directors has proposed another right issue to increase the authorised capital of the company from Rs2.5 billion to Rs10 billion and has empowered the management to undertake necessary steps for reorganisation of the existing finance facilities.

HASCOL has completed its Lube Oil Blending Plant where Fuchs Middle East will have a 50 percent equity position in the facility. This might help the company in invigorating its lubricants sales with a positive impact on the profitability. While any development on the issue of exchange volatility for the OMCs taken up by the government will bring the much needed respite in the downstream oil and has sector.

BR100

11,831

Decreased By

-360.2 (-2.95%)

BR30

35,343

Decreased By

-1239.3 (-3.39%)

KSE100

114,118

Decreased By

-2136.7 (-1.84%)

KSE30

35,819

Decreased By

-784.7 (-2.14%)

Comments

Comments are closed.