Looking at the latest financials of Pakistan Telecommunications Co. Limited (PSX: PTC), it is evident that the recent pattern of “gain in one and the loss in another” is repeating itself. In the first half ended June 30, 2019, the group’s main breadwinner – the PTCL Company – continues to struggle to grow its top-line, whereas the two main subsidiaries, Ufone and UBank, continue to do well, helping grow the group’s operating profitability a great deal.

Going into detail, the PTCL Company provided 54 percent of group’s top-line in 1HCY19, down from 59 percent in the same period last year. While the group top-line has grown by over 8 percent in the period, PTCL Company’s revenues have shrunk by almost one percent year-on-year. Even as the group operating profits posted a solid 20 percent growth, the PTCL Company’s operating profitability declined by almost 20 percent, albeit the company still provided two-thirds of the group operating profits.

Most revenue streams at the company saw a decline in revenues for the period. DSL broadband, the main bet, needs to show strong growth, given the scale of unexplored market (broadband penetration stands at roughly 5% of households). A rigid cost structure adds to the woes of business decline, which is made worse by currency depreciation and higher cost of utilities like electricity.

Meanwhile, the two subsidiaries have picked up the momentum, thanks to roughly 22 percent growth in their cumulative top-line to reach Rs30.5 billion in 1HCY19. There is a massive jump in operating profitability – from Rs232 million in 1HCY18 to Rs1.9 billion in 1HCY19. The subs more than covered PTCL Company’s weaknesses and made the group operating profits look better on a yearly basis.

Both Ufone and UBank grew their respective top-line in double digits during the half-yearly period. However, Ufone remains in a net loss of around Rs1.5 billion, thanks to significantly high finance costs during this period. Towards the end, the group’s net profitability was entirely supplied by the PTCL Company.

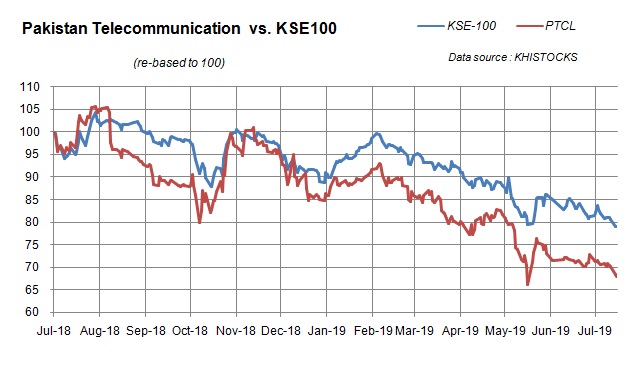

Going forward, the group needs rejuvenation in the PTCL Company’s top-line, along with some tweaks in Ufone’s capital structure to make its debt servicing manageable. While the group has long-term potential, it does not show at the bourse. Over at the PSX, the stock has declined by a third in value over the last 12 months, settling in single digits lately. Can the new management excite the investors again?

Comments

Comments are closed.