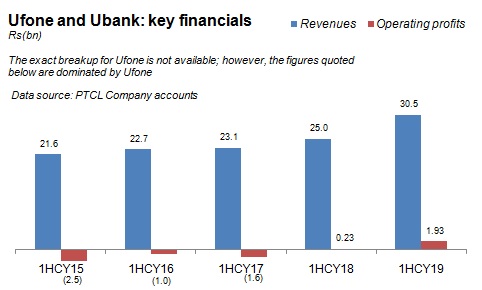

Don’t count it out just yet. The last-ranked cellular operator is having a revival of sorts. After years of scoring losses, Ufone – a subsidiary of the PTCL Group – has now come back to operating profitability. Calculations based on the latest PTCL Group results suggest that Ufone’s top line grew in double digits to cross Rs25 billion in the half-yearly period ended June 30, 2019. The operating profit of the firm was almost Rs1.5 billion in the period, as opposed to a marginal loss in the year-ago period.

Though it is still in a state of net loss, Ufone’s operating performance has considerably improved. The top line has benefited from significant subscription growth in the year ended June 30, 2019.

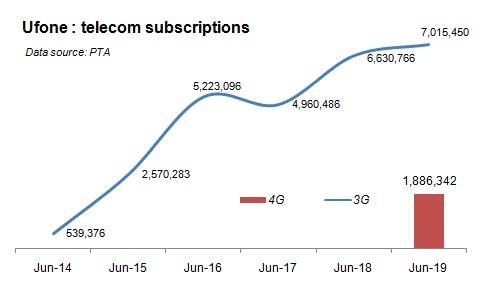

Calculations based on data from the Pakistan Telecommunications Authority show that Ufone’s 3G subscriptions grew by 6 percent year-on-year to reach 7 million as of June 2019. While other operators had their 3G subscriptions decline, Ufone picked up about 400,000 more during the year. As a result, Ufone commanded 19 percent of the 3G subscription base in June 2019, up from 16 percent a year ago.

The story gets even better in the 4G arena. It was only earlier in 2019 that Ufone started launching its 4G services in major cities. Within a few months, the operator has picked up almost two million subscriptions, as of June 2019.

Though other operators have added more subscriptions during the entire FY19, Ufone quickly amassed a 6 percent market share. This sets up the 4G competition nicely for 2020.

While the top line growth and operating efficiencies have helped ameliorate Ufone’s operating profitability in 1HCY19, there is considerable headwind coming from non-core factors. For instance, Ufone’s financing costs are playing a major role in backsliding healthy operating profits into significant net losses. Higher Kibor has, of course, made things worse; but the debt-fueled expansion is now causing troubles.

While Ufone looks set on the road to recovery, the going may get tough. Economic slowdown will weaken the cellular sector’s top line growth. Unless the sector is forced to go for double-digit price revisions, the burden for growth will fall on organic growth in 3G and 4G subscriptions. Then, the network-related costs will increase in tandem with rising energy prices. Savings in operating expenditures and financial costs are in order.

Comments

Comments are closed.