Readying for hot money

The recipe sought to jack up reserves in coming quarters is to attract foreign portfolio investment in government debt securities. It is a risky proposition as interest rates are kept high to keep on attracting fast money – easy to come and even easier to go. One obvious objective is to jack up reserves to bring stability in external account, and other not much talked about advantage is building up of domestic debt capital market by bringing competition to commercial banks in government debt financing, and opening up of domestic credit space for private sector.

The first point is on the potential to attract FPI in government securities. The process has already started. From Jul19 onwards, the gross inflow in T-Bills through SACRA account is $99.6 million while the outflow is $5.8 million. The net amount is $93.8 million – 90 percent of it came from USA while the remaining is invested through UK. In the previous year, nothing came under this head.

Mind you, the taxation and regulatory impediments on this front are yet to be resolved. According to latest ECC meeting of the cabinet, WHT rate for non-resident companies, not having a permanent business in Pakistan, investing in debt market is approved to reduce from 30 percent to 10 percent and it would be full and final liability. The other tax such as banking transaction tax for non-filers will not be applicable as well.

Governor SBP is confident that once regulatory roadblocks are over, the inflows will grow. He told the cabinet that he is in talks with Citi Group for attracting big investors. He is eying to emulate the happenings in Egypt. Right after entering into the IMF programme, steep currency depreciation (in Nov-16), and jacking up interest rates, the portfolio money came in big chunks - $30.7 billion net flow during Jan17-Mar18 (majority of it in government securities).

The Egyptian pound almost halved in Nov-16 and thereafter (barring a quarter of volatility) remained stable at new rates. The interest rates increased by 300 bps to 15.25 percent in Nov-16 – at the time of one-time big currency depreciation. The hot money started pouring in. Interest rates increased to 19.25 percent by Jul-17 and started tapering off from Feb-18.

Interestingly, the net portfolio flows became negative with easing in monetary policy - $8.7 billion was evaporated during Apr18-Dec18. That is what hot money does. It comes in when returns are high and moves out to another avenue once the juice is extracted. It is high maintenance, and not a long term companion.

The inflows in Egypt were too high; and there is history to it. Egypt is in a region which is a choice avenue of foreign investment. The country is a known tourist attraction and the flows increased in this regard as well – as tourism in Egypt became cheap after currency devaluation. But in Pakistan, debt portfolio flows never came and it is not a choice tourism destination wither. The government is trying on both ends - but it is a virgin territory.

Seeing the experience of Egypt, the interest rates are likely to remain up till the time portfolio debt investment is eyed to flow in. No one is expecting similar numbers – even 10 percent of Egyptian flows will be trumpeted in Pakistan. It’s a game of big investors who can leverage and make quick gains by borrowing from low rate markets and invest in high rate risky markets.

Citi bank has a treasury presence in Pakistan and may attract some investors. Local groups like Arif Habib, JS, BMA etc are trying to lure their investors too. But these houses have expertise in equity investment; and debt is not their strong suit. They may partner with other international houses like JP Morgan, Merrill Lynch etc to compete with Citi. The optimism these guys have is that debt flows might be followed by equity flows; and they are bullish on implication of reserves building.

The other element due to opening up of domestic debt market is on the overall debt capital market and private sector credit. The debt market in Pakistan is thin and is dominated by government debt invested by commercial banks. There is not enough trading in the market to establish a yield curve; and without it, the corporate debt market cannot be developed.

Once foreigners’ investment starts flowing, the debt capital market is bound to grow and this will pave way for other instruments. The commercial banks will have to compete and earn for their spreads. The big corporate can create space in debt market and commercial banks may be compelled to lend to SME and commercial segments.

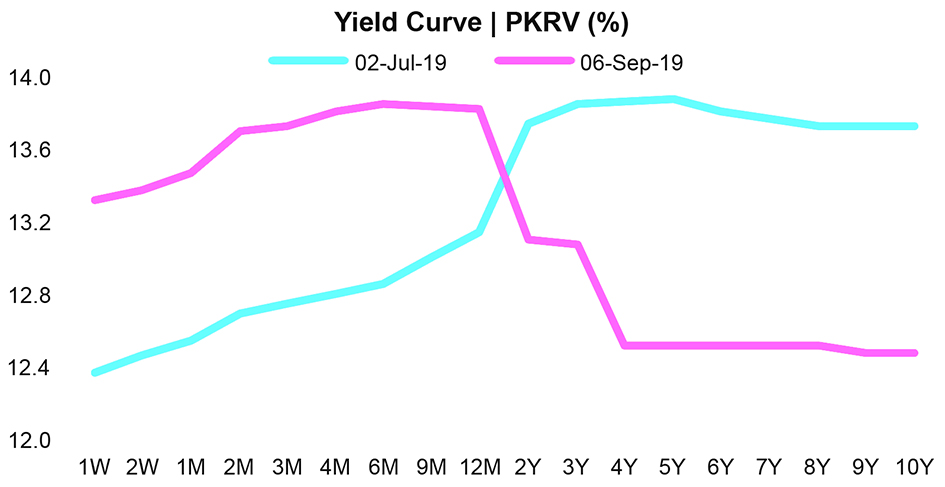

The secondary market yields of higher tenure papers are falling in the past few weeks while short term papers rates are stable – yield curve inversion is increasing; and market is responding to economic changes in the secondary market. Now theoretically, long term bond for corporate can be issued at lower rates than short term working capital borrowing from a bank – that is the first step. Once there are more flows in the debt market, pricing signals would be strong to have an impact.

Comments

Comments are closed.