WPI indicating more double digit CPI

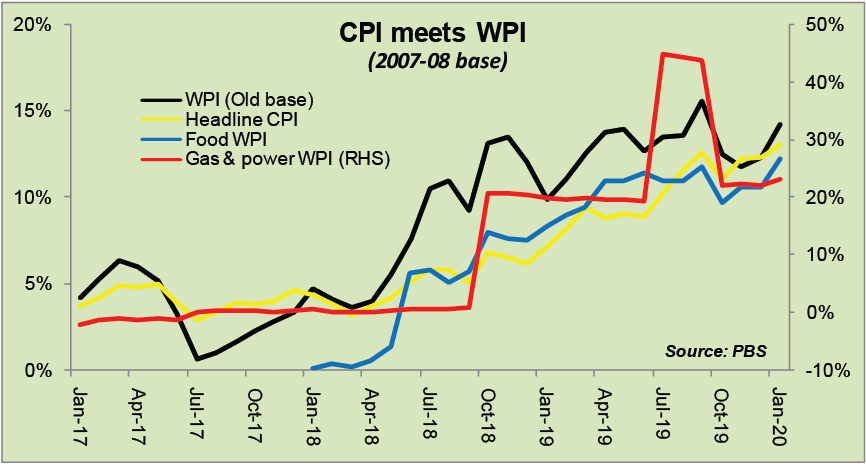

Many in the market may have been taken by surprise on the multiyear high CPI inflation for January 2020. Granted, that it was food driven, and not all of it was seen coming. But what was seen coming was double-digit headline inflation, and one that would not go away easy. BR Research had flagged the warning as early as July 18, 2019 (read: WPI heating up) as the Wholesale Price Index (WPI) was showing things heating up in the months to come, as it has acted as a reliable leading indicator. And things have heated up alright.

With January 2020 CPI inflation making headlines, WPI movement is warranted another look if it is again acting as a leading indicator. There appears to be a broad consensus on CPI inflation having peaked in January 2020. But then there was consensus earlier too, on inflation having peaked back in October 2019. Granted, no one saw the so-called sugar, wheat, onion and all sort of perishable and non-perishable food supply chain crisis coming.

Food sub-sector WPI (2007-08) base has notched up its highest reading in many years. Hardly surprising, as food CPI is also at a multiyear high. Only that while the recent surge in CPI inflation is primarily driven by food prices, the WPI is still heavily based on energy prices. WPI readings of food sector tend to move in tandem with the overall WPI reading – and it does not come across as a leading indicator. The recent surge in WPI of food sector, is by and large believed to be already incorporated in the CPI food movements.

It is the gas, power and transport related WPI that seems to be a good indicator of CPI. Recall that the energy related inflation had caused quite a stir in 2019. While there is significant difference between the CPI readings of new and old base for gas and power, there is not much between that for WPI. That is primarily because the new methodology considers different slabs for domestic consumption. Another reason is that the domestic sector, unlike commercial sector has been largely absolved from massive gas and power related price hikes.

The new base WPI readings for gas and power in fact lead to higher readings than the old base, whereas, it is the opposite with CPI. That is where WPI gas and power continue to be the most important leading indicator for CPI, having a considerable combined weight of 12 percent. In terms of impact, the gas and power subsector still has the highest impact even after the latest round of food inflation. Food with a 20 percent WPI weight, is catching up, but that could be short-lived, with food prices expected to return to normalcy.

So while the market may be right in expecting CPI to have already peaked, who is to say the energy prices won’t face another significant round of upward revision. Yes, the government may want to minimize the impact on domestic consumers on both gas and power fronts, but that relief will invariably be a burden on other sectors, such as commercial. Don’t rule out another round of energy related WPI inflation, leading to higher CPI down the road. Not just yet.

Comments

Comments are closed.