GIDC projects: There's nothing on ground, observes SC

The Supreme Court Monday noted that the Gas Infrastructure Development Cess (GIDC) projects were conceived in 2011 but after nine years there was nothing physical on the ground.

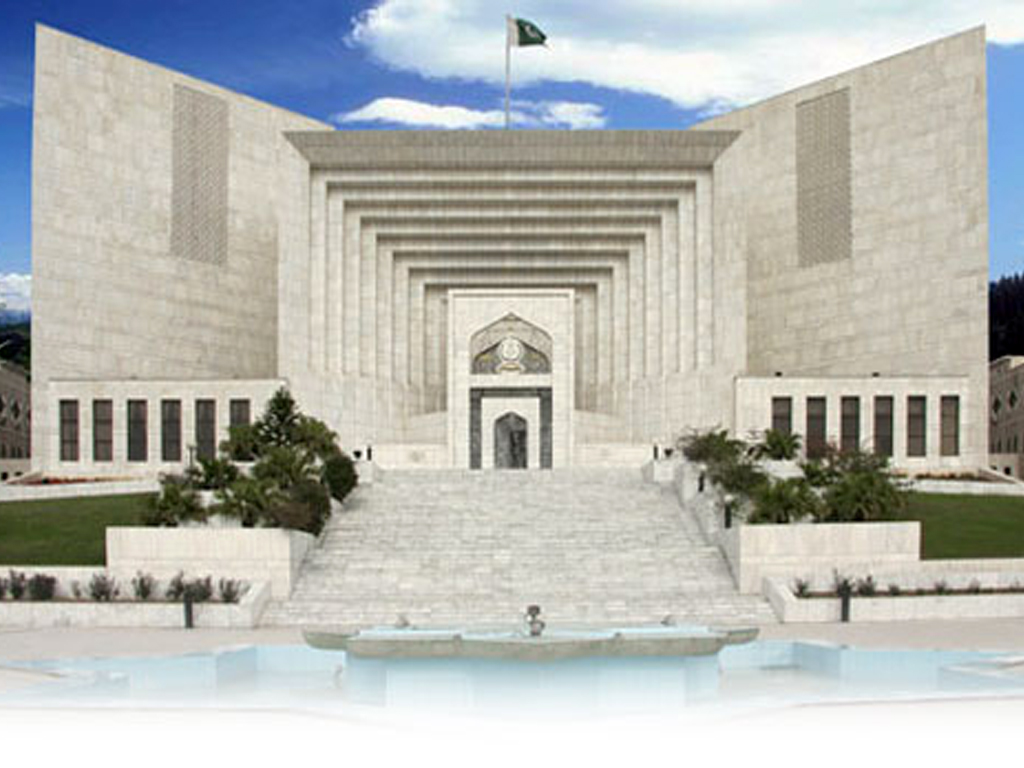

Justice Mansoor Ali Shah observed that the government started collecting the GIDC in 2011. The projects are heavily dependent on the GIDC. The projects, so far, are on paper, and there is nothing on the ground, he added. A three-member special bench, headed by Justice Mushir Alam, on Monday heard 107 petitions/appeals of various textile mills, cotton mills, sugar mills, ceramics companies, chemicals, CNG filing stations, match factories, cement companies and aluminum industries regarding GIDC levy.

Justice Mushir said that when the matter of GIDC was brought in the Supreme Court then the government started the paper work and prepared future plans.

The government seems to be relying only on the funding and taxes, while no funding from other sources have been generated for these projects.

Makhdoom Ali Khan said that collection by the federal government in respect of the GIDC far exceeded the service provided.

"In fact, the services are zero," he claimed. "When the fee becomes excessive then the government has to provide service."

Mobin Saulat MD/CEO of M/s Inter-State Gas System (ISGS) Limited apprised that Iran has completed work on its side regarding Iran-Pakistan gas pipeline, while no physical work has been done on the Pakistan side. He said that total cost of pipeline project, Turkmenistan-Afghanistan-Pakistan-India (TAPI) Pipeline was $10 billion in that Pakistan's share was Rs31.3 billion, which would be paid from the GIDC.

Around 816 kms land would be utilized; the state land is 70 percent, while 30 percent land has to be acquired.

Turkmenistan has laid down pipeline up to Afghanistan.

Justice Mansoor asked from the CEO ISGS when the Ministry of Defence had issued notice, then why ground work on Pakistan side of the TAPI project could not be started.

"Has it anything to do with the US sanctions [on Iran] on this project?"

About the North-South Gas Project, Mr Saulat informed the court that this project also could not be started because the government has not released funds for it. "We have written to the relevant authorities a number of times, but there is no response," he stated.

Accountant General Pakistan Revenue (AGPR) Sardar Azmat Shafi submitted a single page report.

According to that from Financial Year (FY) 2011 to 2018-2019, Rs295.402 billion have been deposited in the FCF under the GIDC head.

These receipts were accounted for C-Non Tax Revenue from FY 2011 to 2016-2017.

For the last two years, they were accounted for as B-Tax Revenue in financial statements of the federal government.

The Ministry of Finance has already initiated the process to rectify this classification.

The GIDC receipts of Rs295.402 billion are being maintained at the State Bank of Pakistan.

Azmat submitted that the AGPR compiles the accounts of the federal government on cash basis under Article 170 of the Constitution. The receipts are accounted for when cash is deposited in non-food account.

The record of receivables, if any, is maintained by the concerned controlling ministry/division.

The case was adjourned until Tuesday (today).

Comments

Comments are closed.