Bestway and Fauji sailing south

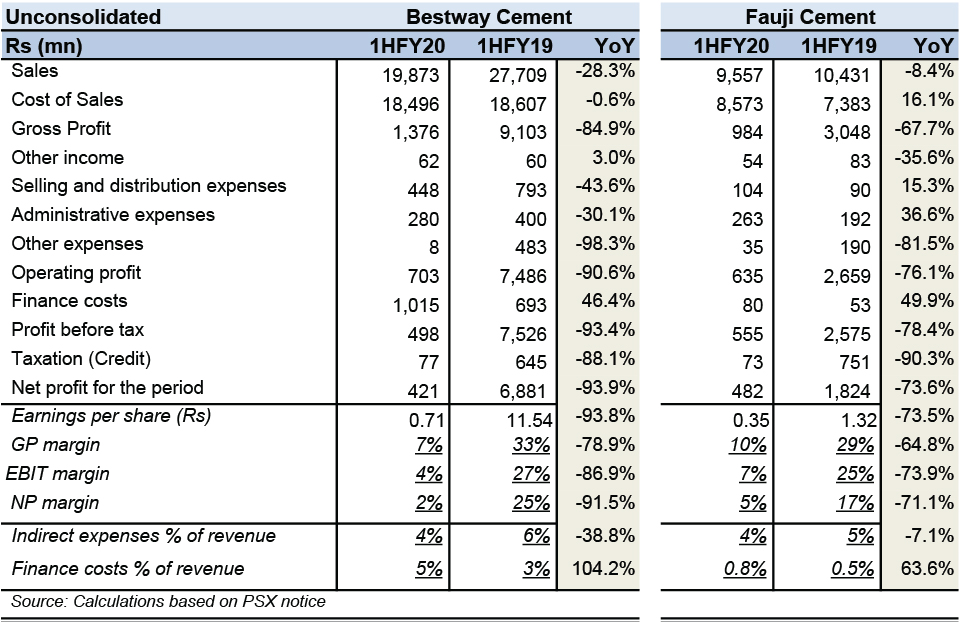

Unlike some other cement companies located in the north zone and supplying mainly to those markets, Bestway (BWCL) and Fauji Cement (PSX: FCCL) have both earned a profit in the half year ending FY20, though bottomline for both firms fell below Rs500 million. At a time when demand is low, and price competition is intense, this is a pretty good outcome.

In the first quarter, Bestway saw cement production drop by 12 percent which led to lower dispatches (down 9% overall) in the markets, and as a resulted revenue dropped 21 percent—the drop higher due to competitive prices in the domestic north market. Suspension of exports to India caused overall exports to drop 60 percent. This was only exacerbated by weak domestic demand. In 1HFY20, Bestway’s revenues dropped over 28 percent. Evidently, circumstances did not change in the winter.

Margins also shrank from 33 percent to a single-digit. Though average global coal price in 1HFY20 came down 32 percent compared to the corresponding period last year ($99 per ton vs $67 per ton for South African coal), it seems lower retention prices together with higher electricity tariffs chipped away at the margins substantially.

Fauji’s margins are not too different. In the first quarter, Fauji credited its drop in margins to a 36 percent rise in WAPDA tariff, increase in royalty on limestone and clay of over 100 percent and increase in raw material and coal prices due to the axle load limitation (the said restriction had caused transportation costs to go up). The company claimed that a 2.5 MW solar power plant was in the works which would help the company cut down on power costs.

Both companies kept overheads largely in check. Bestway’s finance costs rose to 5 percent of revenues (1HFY19: 3%), which was expected due to higher cost of borrowing as discount rate in the country rose. Being market leader, Bestway started with a much higher top-line, but it was behind Fauji when it came to the bottom line as the latter ran a tighter ship incurring nominal financial costs and keeping cost of production down. If domestic demand does not improve, prices will remain under pressure especially as capacity in the industry has substantially expanded. That would result in a sobering year-end.

Comments

Comments are closed.