The Supreme Court issued notice to the Attorney General for Pakistan regarding interpretation of Article 165-A of the Constitution and Section 122(2) of Income Tax Ordinance (ITO) 2001 that whether entities established under the provision of statutes would be exempt from the payment of tax with retrospective effect?

The Supreme Court issued notice to the Attorney General for Pakistan regarding interpretation of Article 165-A of the Constitution and Section 122(2) of Income Tax Ordinance (ITO) 2001 that whether entities established under the provision of statutes would be exempt from the payment of tax with retrospective effect?

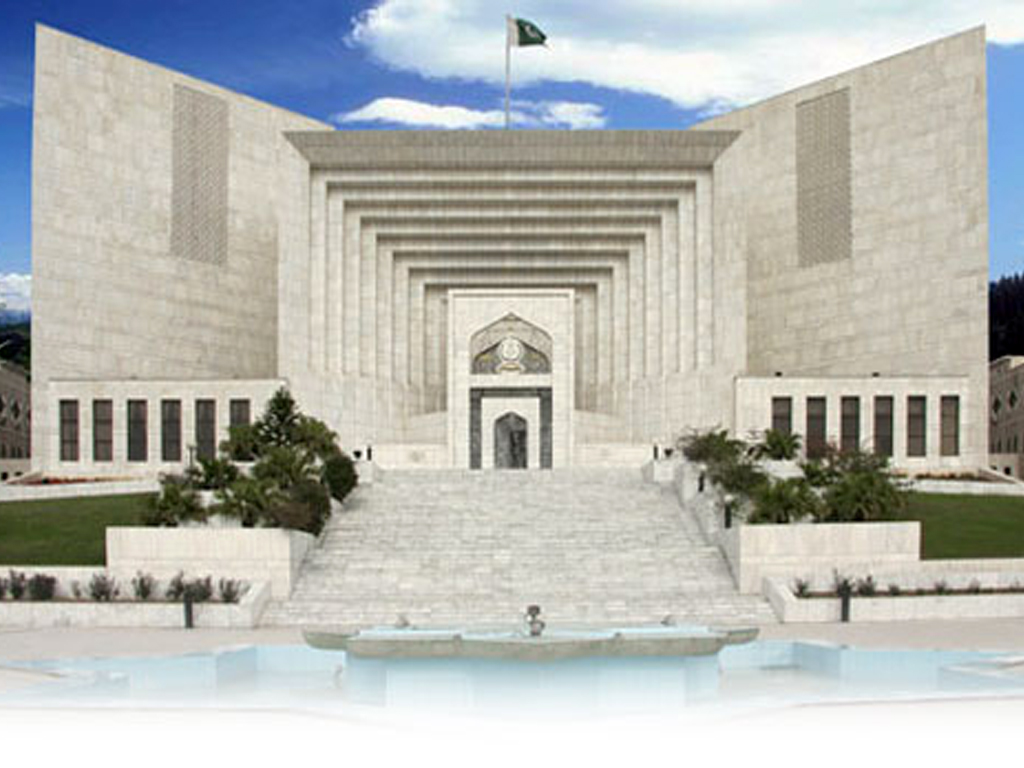

A three-judge bench, headed by Justice Umar Ata Bandial, heard the Federal Board of Revenue (FBR)'s appeal against the Islamabad High Court (IHC) judgments. The IHC has given conflicting judgments regarding the matter.

The judgment authored by Justice Mian Gul Aurangzeb said that Section 49(4) of ITO could not be given retrospective effect, while Justice Shaukat Siddiqui's verdict ruled that it can be given retrospective effect.

Babar Bilal represented the FBR, while Barrister Ali Zafar appeared on behalf of the Securities and Exchange Commission of Pakistan (SECP). Justice Umar Ata Bandial said the departments instead of approaching the court should have settled the issue themselves.

He observed that the SECP and Ogra had not concealed or misreported their accounts. Justice Mian Gul Aurangzeb's verdict noted that the National Electric Power Regulatory Authority, established under the provisions of the Regulations of Generation, Transmission and Distribution of Electric Power Act, 1997; Zarai Taraqiati Bank Limited, registered under the provisions of Companies Ordinance, 1984; Defence Housing Authority, established under the provisions of Defence Housing Authority Islamabad Act, 2013; and Oil and Gas Regulatory Authority established under the provision of Oil and Gas Regulatory Authority Ordinance, 2002.

The Islamabad High Court in SECP vs Commissioner Income Tax (Audit) held that the "SECP is creature of federal government through the womb of Securities and Exchange Commission of Pakistan, Act, 1997, and it has the identity independent of the federal government. Though the federal government controls SECP but this fact by itself does not crown it to the pedestal of being federal government itself." Its employees are the subject of its regulations and not to the Civil Servants Act, 1973.

IHC had observed that there is no provision in any of the statutes establishing the authorities exempting them from the payment of tax under the provision of the 2001 Ordinance.

The said entities can also not be termed as 'local authorities'. The IHC said that Article 165 of the Constitution has consistently been interpreted to make the income or property of the federal government liable to taxation under an Act of Parliament unless specifically exempted from the operation of such an Act.

The IHC declared the said bodies/entities do not come within the meaning of 'local government' or 'local authority' therefore cannot claim exemption from the payment of income tax under section 49(1) to (3) of Income Tax Ordinance 2001.

About Section 49(4) of 2001 Ordinance the high court had noted that it is a declaratory legislation meant to achieve the purpose, which had already been achieved by Article 165-A of the Constitution.

The court held that mere fact that section 49(4) was inserted in the Income Tax Act through the Finance Act, 2007, this by itself did not mean or imply that prior to the said insertion, the said entities/bodies were exempt from payment of income tax. However, the court said that Section 49(4) of ITO could not be given retrospective effect.

Comments

Comments are closed.