Gatron Industries Limited

Gatron Industries Limited (PSX: GATI) was established as a public limited company in 1980. It produces Polyester Filament Yarn, Pet Forms, and can also produce PET Bottle Grade Chips. It also produces Polyester Polymer/Chips which it uses to produce Polyester Filament Yarn.

Shareholding pattern

The directors, CEO, their spouse and minor children hold about 43 percent of the shares. A further breakdown of this category was not available. Nearly 35 percent is distributed between the local general public, followed by banks, DFIs, NBFIs and investment companies which hold about 16 percent.

Historical operational performance

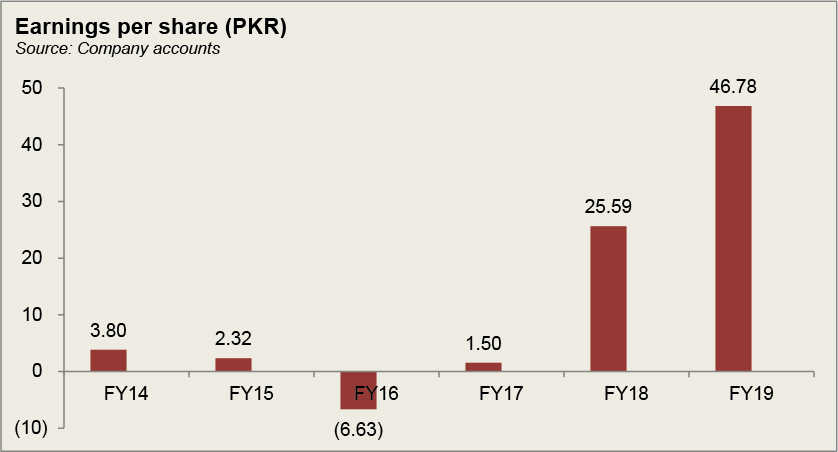

In FY14, the topline of Gatron Industries was recorded at close to Rs12 million. This was attributable to a huge contract the company had received with a national institution. The contract had happened in the previous year but the effect was seen in FY14. However, it came with significant costs, which actually pushed the margins down for the year. The higher topline did not translate into a higher bottomline as well, had it not been for the income earned from dividend. In its absence, the company had already posted a negative profit before taxation, which would have escalated if dividend income had not held up profits. However, it still could not lift margins.

The topline declined in FY15 due to a number of factors. The company faced the problem of imported yarn which was cheaper, and dumped under invoiced fabric. In addition, rising energy costs also contributed to rising costs. Power, fuel and gas amount made up 18 percent of the total cost, while total cost of manufacturing itself consumed 99 percent of the revenue. Again income from dividends earned form wholly owned subsidiary and associated company aided the bottomline. Yet margins continued to decline.

Gatron Industries’ topline continued to fall year on year in FY16 by close to 15 percent. This was due to falling prices in the Polyester value chain along with “lower yarn offtake”. The company was unable to cover costs of manufacturing leading to a gross loss. Imported cheaper yarn from China and Malaysia were largely to be blamed as it did not allow for higher prices to be charged. The matter had been taken up with the National Tariff Commission; however, the process had been rather slow. With the company unable to cover cost of manufacturing, the operating and net margins naturally exacerbated year on year, to their lowest levels seen thus far.

The growth in net revenue recovered in FY17, registering a growth rate of 40 percent year on year. This was sourced from PET Preforms segment which experienced higher production due to greater capacity. Moreover, product prices also saw an upward trend, unlike previous year. In addition to this, other costs were also curtailed which allowed margins to improve. However, there were some reliefs for the company towards the end of the year; the government imposed 5 percent regulatory duty on the import of Polyester Filament Yarn while NTC also imposed anti-dumping duties on PFY imported from China and Malaysia.

In FY18, topline grew although by a much lower rate of 5.5 percent compared to previous year’s 40 percent. The effect of regulatory duty on imports materialized in FY18 whereby the company experienced the highest production as well as sales of Polyester Filament Yarn seen in the last three years. In addition, higher product prices also contributed to the topline while raw material was purchased when prices were low, thus allowing margins to improve considerably. Some support was also brought in by dividend income which allowed net margins to exceed operating margins.

Unlike many other companies which were affected by the political and economic instability, FY19 was a profitable year for Gatron Industries. The topline of the company grew by 36 percent as a consequence of an increase in volume as well as selling price of Polyester Filament Yarn. The latter was brought about by rupee devaluation. In addition to an improvement in net revenue, costs were also controlled while dividend income continued to provide support to the bottomline taking net profits beyond gross profits. Net margin was the highest in FY19 since FY12, both in percentage point and absolute terms.

Half yearly results and future outlook

In 1HFY20 sales dropped by 17 percent. This was due to a volumetric decline in both the segments- PFY and Preforms. The decline occurred due to imported products available in the market as well as 17 percent sales tax on textile sector in the June 2019 budget. Moreover, the condition of CNIC on unregistered traders also impacted business activity. The lower sales had a significant impact on the bottomline, in addition to dividend income being nearly halved year on year causing net margins to have a similar effect.

The falling raw material price towards the end of FY19 made traders avoid importing extra quantities which resulted in less downward pressure on PFY prices. However, the company does not expect this to repeat in FY20 as the currency has stabilized. In addition, the regulatory duty previously imposed had been eliminated which implies that PFY market and price will be affected.

Comments

Comments are closed.