Highnoon Laboratories Limited

Highnoon Laboratories Limited (PSX: HINOON) was established in 1984 under the Companies Act, 2017. It was converted into a public limited company in 1995. Highnoon Laboratories operates within the pharmaceutical industry and its manufacturing facility is located in Lahore.

Its therapeutic products cater to nervous and respiratory system, cardiovascular, parasitology, endocrine, antihistamines, among many others.

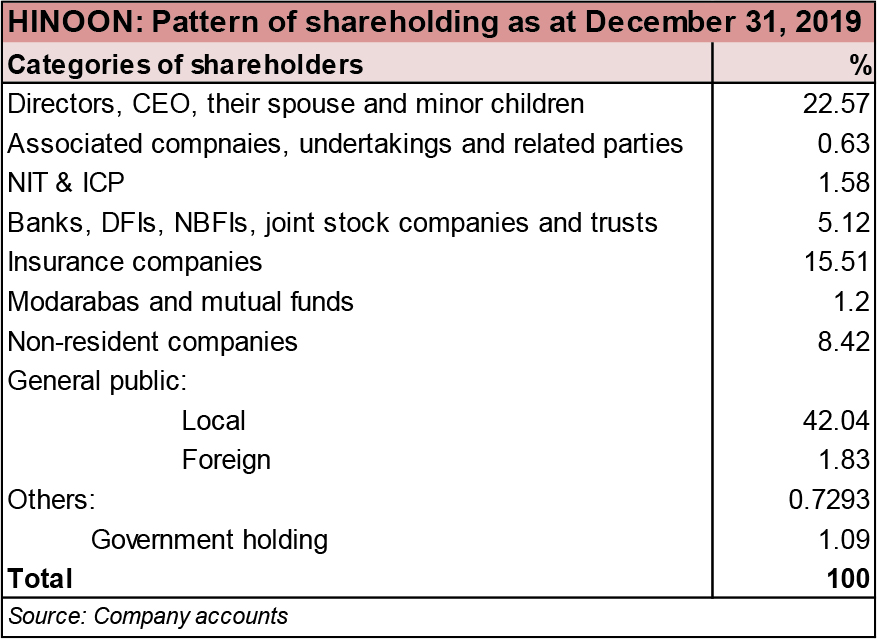

Shareholding pattern

The director, CEO, their spouse and minor children hold around 23 percent of the company’s shares. Out of this, Mr. Taufiq Ahmed Khan who is one of the directors on the board of Highnoon Laboratories owns nearly 10 percent while 7 percent is with Mr. Tausif Ahmed Khan who is the Chairman. About 42 percent is with the local general public followed by insurance companies which owns around 15 percent; out of this, 11 percent is with Jubilee Life Insurance Company Limited.

Historical operational performance

Highnoon Laboratories has seen a gradual traction in its revenue over the decade. Profit margins also followed more or less a similar pattern.

In CY13 and CY14, net revenue significantly jumped by 22 and 23 percent, respectively. Highnoon Laboratories sales constitute of domestic sales as well as exports, although the latter makes a lesser contribution. In CY14, domestic sales grew by 23 percent while export sales registered a 12 percent increase. The company largely gained volumetrically, by 15 percent year-on-year. Volumes were driven by both, newly introduced brands and established ones. Within the domestic scope, chronic therapy was a major contributor. Respiratory, cardiology and alimentary tract segments made up nearly 80 percent of their portfolio.

Between CY13 and CY14, there was a notable decline in share of the cost of manufacturing in the total revenue earned. Apart from enhanced productivity, a favourable exchange rate also helped to reduce cost of manufacturing. Thus profit margins significantly improved year on year.

There was a 19 percent year on year increase in revenue during CY15. Again it was mostly driven by higher volumes- an increase of 14 percent. Higher expense on expansion of sales teams showed results as export sales grew by a considerable 25 percent. Last year the company had tried to penetrate the Afghanistan market. Its positive results were seen in CY15 as sales revenue from Afghanistan increased by 61 percent year on year. The company plans to explore Sri Lanka, Kenya and Philippines.

Most of its star products in the therapeutic segments either performed in line with the industry or surpassed it. Costs as a percentage of revenue also declined due to cheaper alternatives for sourcing raw materials. Thus, gross margin reached its highest level seen in the decade, with operating and net margins also improved significantly. In September 2015 Highnoon Laboratories also acquired Biocef (Private) Limited.

The company remained on its growth trajectory in CY16 as its topline grew by 15 percent year on year; although a lower rate than seen previously, but double digit growth, nonetheless. Apart from sales generated from established brands, the company’s new products have also been received well in the market, contributing to a volumetric growth. In addition, the company is also near receiving approvals from the concerned regulatory bodies in Sri Lanka, Philippines, Tanzania and Kenya which will add to the topline in the following years. With most other elements remaining unchanged or experiencing marginal change, the profit margins remained stable. As per the plan, Highnoon Laboratories acquired 100 percent of the shares of its subsidiary company.

During CY17, the company grew its topline by almost 18 percent. As per the company’s annual report, the company’s focus is towards expanding international markets. This is evident by the fact that export sales continue to grow each year. In CY17 revenue from exports grew by 36 percent, while revenue from local sale increased by 19 percent. The company was able to add Somalia, Tanzania and Zambia as its export markets. Growth in alimentary tract, metabolism, cardiometabolic and respiratory segments which constitute a major chunk of their portfolio, exceeded the industry growth. Foreseeing potential demand, the company also entered into the herbal medicine category. However, given that costs remained more or less similar, profit margins also experienced only marginal changes.

Topline experienced a significant increase of a little over 25 percent in CY18. It added to its portfolio products from its subsidiary and associated companies. Export sales however remained flat during the period due to border closure and change on distribution set up in Afghanistan. Since the pharmaceutical industry is dependent on imported raw material, costs slightly rose as a percentage of revenue reducing profit margins faintly.

Capacity utilisation levels could not be calculated as “it is a multi-product plant involving varying processes of manufacture”.

Recent results and future outlook

Highnoon Laboratories grew its topline by a little over 20 percent year on year in CY19 with volumes increasing by 10 percent. It experienced growth across the board in all its segments. It’s fairly recent segment of herbal and nutraceutical products registered a 13 percent growth. Cost of raw materials which made around 70 percent of the total cost of manufacturing resulted in cost of manufacturing to increase as a percentage of revenue causing gross margins to decrease. Other income lifted the operating and net margins slightly.

The industry operates in a highly regulated environment; therefore, the increase in cost of production cannot be passed on to the consumers directly. Thus the company hedges this risk by focusing on export markets and lobbying for a fair drug pricing policy, apart from striving to achieve cost efficiency. Given that the company has fared well during testing times, and kept costs in check during periods of double digit inflation, Highnoon Laboratories foresees stable growth in the future.

Comments

Comments are closed.