Otsuka Pakistan Limited

Otsuka Pakistan Limited (PSX: OTSU) was established in 1988, as a public limited company. However, it did not start commercial production until September 1989. It is indirect subsidiary of Otsuka Pharmaceutical Company Limited, Japan.

The main activities of the company are manufacturing, marketing and distribution of I.V solutions. Additionally, it also provides medical devices like knee joints, clinical nutrition, and therapeutic drugs. Its factory is located at Hub, Balochistan. More than 90 percent of the company’s sales are mad in the domestic market, with a very inconsequential share exported to Afghanistan.

Shareholding pattern

Associated companies, undertakings and related parties own nearly 67 percent of the company. Of this nearly 45 percent of the shares is taken up by Otsuka Pharmaceutical Company Limited. A little over 17 percent is distributed with the local general public while the directors, CEO, their spouse and minor children own a relatively small share of 3 percent.

Historical operational performance

There has been a gradual decline in profits since FY11, before picking up again in FY15, reaching a high in FY17 and FY18, and incurring loss again in FY19.

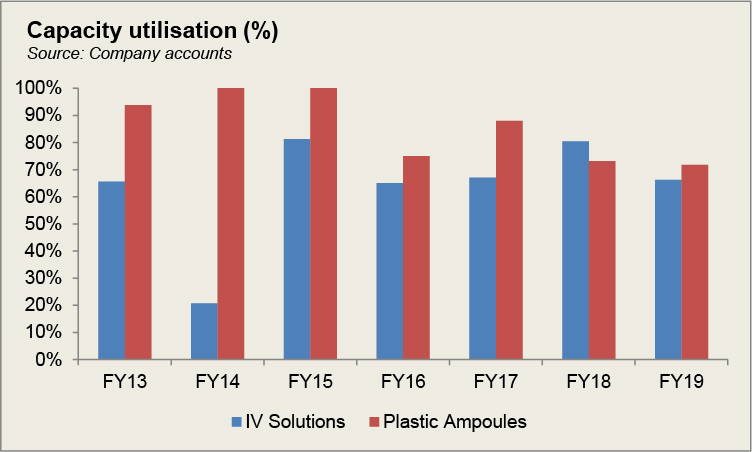

In FY14, the company undertook a major renovation project for IV solutions, which took up more than half of the operational year. IV solutions constituted 70 percent of the sales therefore the effect on the books was drastic. Although the factory was closed for a good nine months, fixed costs could not be avoided causing costs to consume all of the revenue, eventually leading the company to incur a loss.

Therefore, when operations resumed a month prior to the last quarter, and continued during the next year (FY15), the growth rate in topline was impressive at nearly 35 percent. With recovered losses, costs were also spread out, causing gross margins to improve as well year on year. While there was negligible change in other factors, finance costs had surged during the period. This was as a result of revamping and renovation projects undertaken in the preceding year for which the company had borrowed heavily. The company did still incur a loss for the year, however, the losses were reduced year on year.

In FY16, Otsuka Pakistan was able to grow its topline by close to 7 percent year on year. This was due to better volumes and an increase in selling price. There was a reduction on the costs side as well coming from a fall in fuel and power expenses primarily. A significant incline in other expenses was seen during the year arising from exchange loss. The company had taken a foreign currency loan from its related company, Otsuka Pharmaceutical Company Limited in Japan. the exchange loss was “pertaining to mark-to-market losses on foreign currency denominated liabilities”. This created a slight dip in operating margins but a lower finance cost allowed net margin to improve year on year.

Topline in FY17 saw a double digit growth of 18 percent based on an increase in selling price as well as addition of two new products to their product portfolio. The company also kept a strict control on costs given the industry limitation to increase prices. This resulted in an unprecedented improvement in gross margins. Some support to the bottomline was also brought in by other income coming from a net exchange gain. In addition, finance cost reduced considerably due to repayments of short term and long term loans. Thus profit margins took off.

Growth in the topline was a little subdued at 2 percent relative to that seen in FY15 and FY17. This was due to intense competition in the IV infusion market and the problem of oversupply as well. Cost curtailment allowed the company to reach its gross margin target of 30 percent. However, the elevated distribution costs and other expenses nearly halved the operating and net margins. The devaluation of the currency resulted in an exchange loss on the company’s foreign currency denominated liabilities, seen in the ‘other expenses’ category. Distribution costs were mostly driven by advertising and promotion expenses. This has been imperative due to the cut-throat competition seen in the industry.

The problem of oversupply restricted sales which only grew marginally by less than 1 percent in FY19. During the period, the devaluation of the currency adversely impacted the cost of production, as it consumed nearly 80 percent of the revenue. Moreover, the resultant net exchange loss doubled ‘other expenses’. The company also spent heavily on distribution to gain market share, thus it incurred an operating loss. The upward movement of the bank rate locally to a double digit figure convinced the company to continue with the loan taken from Otsuka Pharmaceutical Company Limited Japan. Thus the recovery seen post FY14 was short-lived.

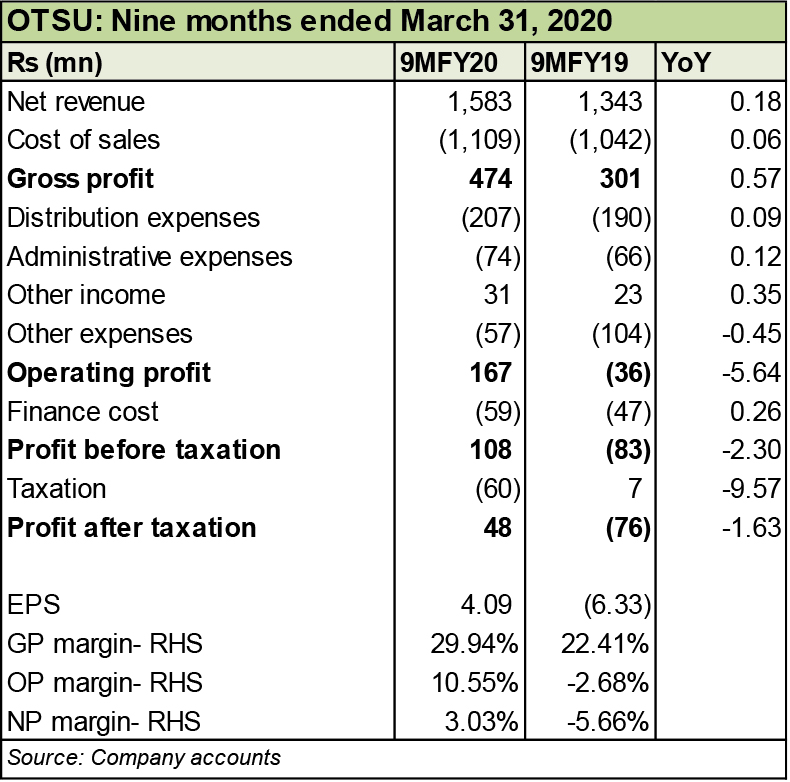

Quarterly results and future outlook

The nine months ended on March 2020 saw sales increasing by close to 18 percent year on year. However, cost of sales as a percentage of revenue reduced incredibly from around 78 percent in 9MFY19 to 70 percent in 9MFY20. The company managed to curtail its distribution costs slightly. Other expenses were nearly half during the period on account of lower exchange losses.

With no other change, the company may be able to post a positive figure for its bottomline at the end of FY20. However, given the prevalent situation of questionable supply chain and a subdued business activity, the company foresees slow business activity. Industry wide factors on the other hand, which have negatively impacted the sector, are the price regulations, delayed product approvals and responses and in the case of Otsuka Pakistan, an interrupted power supply which affects production as well as machinery.

Comments

Comments are closed.