Wyeth Pakistan Limited

Wyeth Pakistan Limited (PSX: WYETH) was established in 1949 as a public limited company. The ultimate parent company is Pfizer Corporation. Wyeth LLC, USA and Wyeth Holdings Corporation LLC, USA are the principal shareholders of Wyeth Pakistan, while the former two are also the subsidiaries of Pfizer Corporation.

The company operates in the pharmaceutical industry, importing, marketing, distribution and sale of ‘research based ethical specialties and other pharmaceutical products’.

Wyeth Pakistan’s accounting year begins in December and ends in November.

Shareholding pattern

The company is primarily held by Wyeth LLC, USA and Wyeth Holdings Corporation LLC, USA, owning 40 and 31 percent respectively. Around 10 percent of Wyeth Pakistan’s shares are with the resident individuals, while the directors, CEO, their spouses and minor children, hold a very negligible share in the company- less than 1 percent.

Historical operational performance

Between 2014 and 2015, the company separated its operations, which caused a contraction in the current business and financials. The profit from discontinued operations, which is more than the current business, is added to the profit from current business, making the statements look profitable, when in fact, the current business is consistently incurring a loss. With this change, there was a drastic fall in topline figure by 55 percent. With the change in operations, similar contraction was also seen in the rest of the factors allowing the negative profit margin of 2014 to reduce as well. The profit from discontinued operations, however, turned the total profit for the year into a positive figure.

Topline further reduced by 9 percent during 2016, as stock for anti TB products remained short, specifically in the first half of the year. This resulted in lower sales for the product. In addition, sales remained lower for some products which cannot be promoted. Costs of production remained consistent at 86 percent of the revenue. With little change in other elements, the effect of lower topline escalated the operating losses year on year, which was made up by profit from discontinued operations, which entailed ‘sale and divestment process of Anne French’, and disposing of its manufacturing facility. A major challenge that the company faced during the year was still of the pricing of pharmaceutical products, the case for which was taken up with the government.

Wyeth Pakistan’s negative growth rate in topline continued during 2017, as its revenue declined by 10 percent year on year. This was due to delayed and lack of orders for anti TB products. Ativan also experienced lower sales for the year. Despite this, gross margin was increased as costs were kept under control. Cost of raw material and packaging significantly declined, from Rs 616 million in 2016 to Rs 185 million in 2017; the company also relatively purchased fewer finished goods during the year. Some support was lent by income from other sources which allowed operating losses to nearly halve. Net margin was primarily spiked due to gain on sale of plant and brands.

The company saw a positive growth in its topline for the first time since 2013- at nearly 6 percent. Sales in the domestic market grew by 16 percent, with products like Myrin and Enbrel being major contributors. Another product, Tazocin, which had not been in the market for two years, also contributed to net revenue. Costs, as a percentage of sales, declined with salary expense under administrative expense halved, and fuel and power cost considerably lower from 2017. In addition, other income increased due to profit earned from saving accounts and term deposits, finally bringing operating profits in the green. Wyeth Pakistan does not have any long term debt or short term borrowings, however finance costs during 2018 escalated suddenly due to exchange loss. With the transaction of disposing manufacturing facility completed last year, net profit was back into losses, albeit lower than previously seen.

A positive growth in topline was short lived as the company experienced negative growth during 2019- a reduction in net revenue by a little over 20 percent. It had been a challenging year for the economy overall due to lower government spending, tight monetary and fiscal policies, inflation and currency devaluation. The decision to document the economy had an adverse impact on its trade sales. In addition, no sales were made in the international market. Moreover, price adjustment for ‘hardship cases’ did not receive approval from the government thus the company was unable to raise selling price.

On the costs side, the cost of sales hiked as a percentage of revenue, with inflation and lower sales. Distribution cost, however, reduced due to reduced salary expense, cost curtailment with respect to travelling and entertainment along with lower expenditure on advertising and promotion. Other income was largely driven by income from financial assets, which essentially kept the financials positive, noted by the fact that other income exceeded the gross margin, and made nearly 16 percent of the revenue.

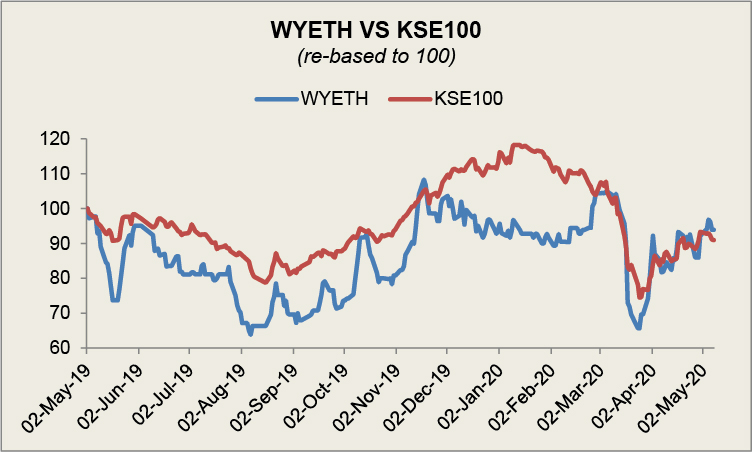

Quarterly results and future outlook

topline in the first quarter ended February 2020 reduced by 25 percent year on year due to subdued business activity, unavailability of certain products and fierce competition in the industry. currency weakening increased cost of sales by 8 percent, with lower sales, the company incurred a loss for the period. Although higher year on year, other income could not lift the company out of loss.

There is no doubt that the ongoing pandemic has brought with it immense uncertainty, and its full impact on financials cannot be entirely ascertained. Aside from this challenge which is faced by companies globally, the company hopes that it will be able to regain profitability with the approval of hardship cases which will allow then to increase selling price correspondingly.

Comments

Comments are closed.