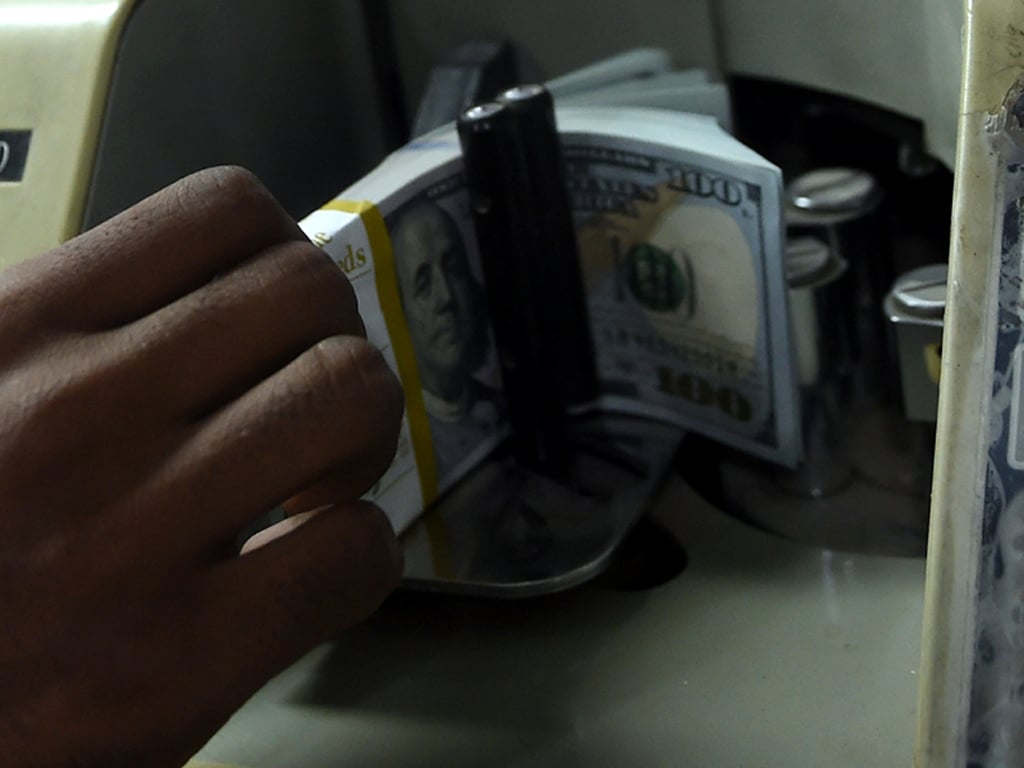

Against USD: Pakistan's rupee weakens further, closes at 173.47

- Rupee has lost over 12% in the last five months

Pakistan's rupee continued to weaken, depreciating another 0.4% to a record low against the US dollar to close at 173.47 in the inter-bank market on Wednesday.

As per the State Bank of Pakistan (SBP), the PKR closed at 173.47 against the USD, a day-on-day depreciation of 69 paisas or 0.40%. On Monday, the PKR had dropped to the-then record low of 172.78.

The PKR has lost over 12% of its value against the greenback since its recent high achieved five months ago, with economic experts expressing concern over rising inflation and the current account deficit.

“If the trend (current account deficit) continues, we are seeing a deficit of $14 billion by the end of this fiscal year, which is a problem,” Saad Khan, Head of Equities at IGI Securities, told Business Recorder.

Pakistan's current account deficit narrows to $1.11 billion in September

Pakistan's current account deficit narrowed to $1.113 billion in September from $1.473 billion in August, said the State Bank of Pakistan (SBP) on Tuesday. The current account balance stood at a surplus of $30 million in September 2020. However, on a monthly basis, the deficit has narrowed around 24%, as an improvement in the balance on trade helped the situation.

Against USD: Pakistan's rupee weakens to record level, closes at 172.78

Meanwhile, Khan was of the view that a current account deficit in the range of $500-600 million per month is "acceptable, as our foreign exchange reserves do not allow us much room".

He said the successful conclusion of International Monetary Fund (IMF) negotiations with Pakistan is also important, adding that fiscal and monetary tightening would stabilise the PKR.

Fitch Ratings revises PKR forecasts downwards

He added that the ongoing hike in commodity prices is also taking a toll as companies are struggling to incorporate the cost increase. “Commodity prices is affecting growth,” said Khan.

Recently, Fitch Ratings also revised its forecasts for the PKR for both this year and next due to a variety of factors including an increased flow of USD into neighbouring Afghanistan.

Fitch’s forecast for 2022 is an average rate of 180 versus a previous forecast of 165.

Inter-bank market rates for dollar on Wednesday

BID Rs 173.30

OFFER Rs 173.45

Open-market movement

In the open market, the PKR lost 80 paisas for both buying and selling against USD, closing at 173.50 and 174.30, respectively.

Against Euro, the PKR lost 1.50 rupees for both buying and selling, closing at 200 and 202, respectively.

Against UAE Dirham, the PKR lost one rupee for buying and 1.10 rupees for selling, closing at 50 and 50.50, respectively.

Against Saudi Riyal, the PKR lost 20 paisas for buying and 40 paisas for selling, closing at 45.90 and 46.30, respectively.

Open-market rates for dollar on Wednesday

BID Rs 173.50

OFFER Rs 174.30

Comments

Comments are closed.